This Week in Critical Minerals - #8

Zimbabwe export ban, falsified LME nickel, and Oyu Tolgoi underground expansion

Welcome to the eighth issue of This Week in Critical Minerals, where I cover the mining and resource processing projects and technologies being built around the world. Let’s dig in.

Lithium

Zimbabwe export ban leading to stockpiles

Last December Zimbabwe’s Mining Minister announced “No lithium bearing ores, or unbeneficiated lithium whatsoever, shall be exported from Zimbabwe to another country,” with the exception of companies currently building processing plants in the country. This export ban is an effort to derive more value from domestic mineral processing, following the model of other developing countries like Indonesia which ramped up nickel processing tenfold in five years after forcing producers to process domestically. Zimbabwe’s export ban is now leading to stockpiling of ore within the country as processing capacity is built, leading to drastically decreased revenues for miners in the country. Now the industry is calling for the ban to be reviewed, as it unfairly benefits larger international companies able to acquire loans to build expensive processing plants, to the detriment of smaller miners who comprise most of Zimbabwe’s lithium mining industry. Larger Chinese players like Zhejiang Huayou Cobalt Ltd have been less affected. Zhejiang operates the Arcadia mine, one of the largest hard rock lithium projects in the world, near Harare in Zimbabwe and has invested $300MM to build a processing plant at the mine. Chengxin Lithium Group and Sinomine Resource Group are also looking to build a processing plant in the country. While an ore export ban may have worked for Indonesia, and is being experimented with all over the world, so far the decision seems to have come too quickly for a growing lithium industry in Zimbabwe.

Nickel

LME nickel shipment turns out to be stones

The London Metal Exchange discovered stones in bags that should have contained nickel at a warehouse in Rotterdam. The falsified metals weighing 54 tonnes amount to 0.14% of live nickel inventories on the LME, totaling $1.3MM at current prices, and were owned by JP Morgan. The LME operates (through a variety of contractors) a network of metals warehouses around the world. Metals are checked for weight and content when they enter the warehouse, but it is still unclear whether this shipment is the result of error, theft, or fraud. This comes after a separate incident shocked the LME in March of 2022, when nickel trading had to be halted and trades unwound following a 250% price spike in a single day. Additionally, it has been just over a month since commodities trader Trafigura discovered fraudulent nickel shipments worth $577MM. The LME does not believe that other warehouses are affected, but its licensed operators are checking nickel stockpiles across its network. The Financial Conduct Authority, the UK’s financial services regulator, announced earlier this month a probe over the LME’s conduct in last year’s nickel crisis, and the exchange is set to announce a series of reforms later this month. Operating a secure network of metals warehouses is critical to the global commodities supply chain, and these sorts of incidents do not inspire confidence in an already embattled LME.

Copper

Peru exports drop 20%, 39 projects in development

Following a wave of protests over the ousting of former President Pedro Castillo, copper exports fell 20.3% in January 2023 compared with January 2022. Sales were down even more at a 25% decrease, due to the fall in volume and a price drop of 5.9% over the same period. Civil unrest across the country has largely subsided, so this drop is only temporary and normal operations are resuming in affected portions of the country. Additionally, the Peruvian Ministry of Energy and Mines announced last week that 2023 will see 74 projects in development for a total mining investment of $596MM, with 30 of the projects expected to become operational in the next year. Copper projects comprise 39 of the 74 with investment of $284MM, while gold has the next most at 18 projects and $220MM of investment. Though troubled in recent months, Peru’s mining sector is still seeing strong investment and is likely to continue to grow.

Ivanhoe Mines sees record profit

Ivanhoe Mines released earnings last Monday, seeing 2022 profits soar to $434MM from $45MM in 2021. The rapid expansion of the company is due to the production ramp up at the Kamoa-Kakula copper complex in the Democratic Republic of the Congo, which sold 323,733 tonnes of copper in 2022 yielding revenue of $2.15B, operating profit of $1.27B, and EBITDA of $1.39B. Ivanhoe has been able to produce copper for $1.39 per pound over the past year, yielding a 65% margin at today’s price of $3.95. When the Phase 3 expansion at Kamoa-Kakula is complete, that production cost should drop another 10-20%. The Kamoa-Kakula mine is one of the largest copper mines in the world, and is operated as a joint venture with China’s Zijin Mining.

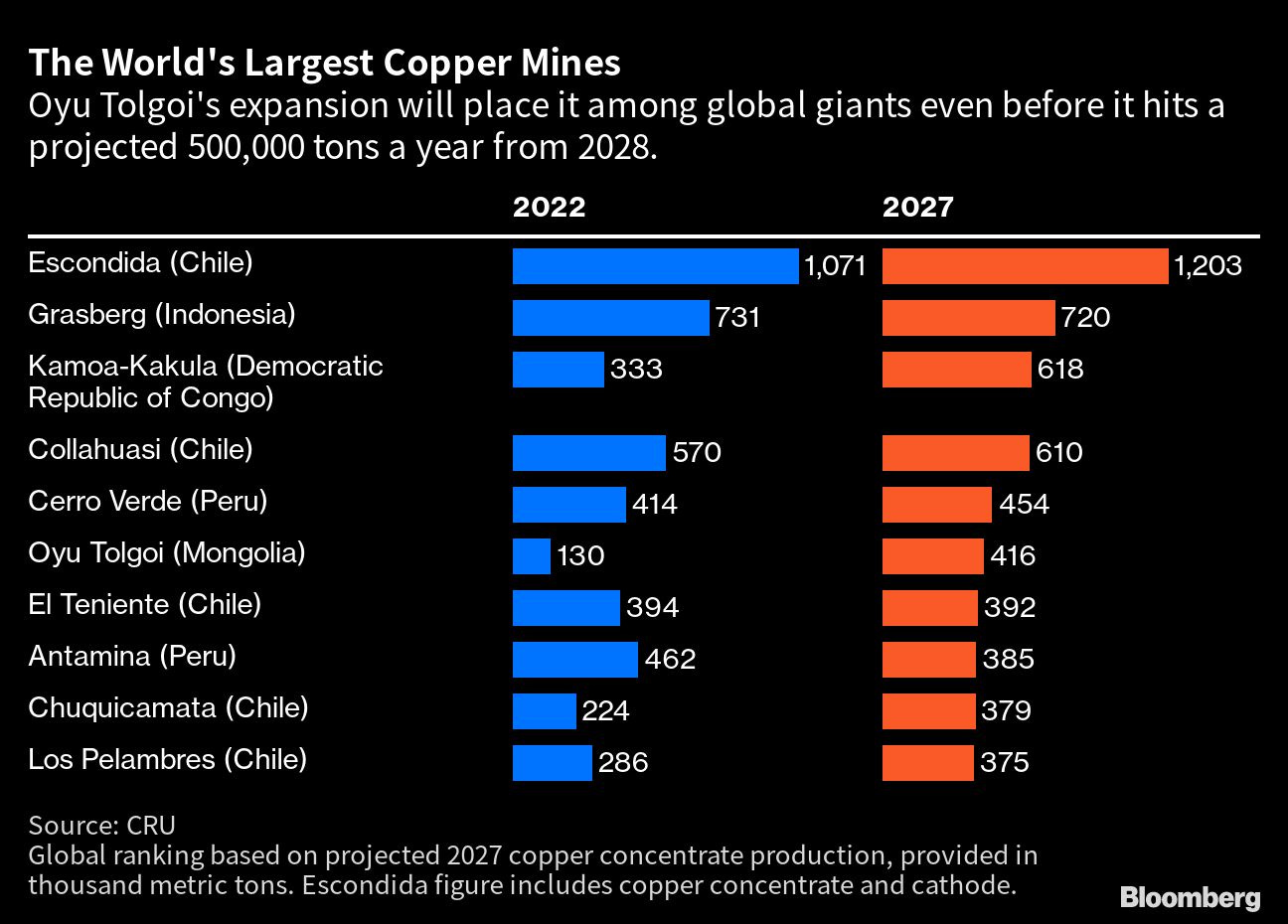

Rio Tinto begins underground mining at Oyu Tolgoi

Rio Tinto has begun mining from an underground operation at the Oyu Tolgoi mine in southern Mongolia. Mining in this part of the Gobi stretches back to the time of Genghis Khan, when outcropping rocks were smelted for copper. Soviets made an initial discovery in the region prior to 1990, but most of the exploration work was done in the late 1990s and early 2000s by Robert Friedland’s Ivanhoe Mines (a separate entity from the existing Ivanhoe Mines). Mining commenced in an open pit in 2013, and in 2012 Ivanhoe Mines rebranded as Turquoise Hill Resources, which as of December 2022 has been bought out completely by Rio Tinto. Over the last decade Turquoise Hill has had some disputes with the Mongolian governments over royalty payments and the fate of the mine’s expansion was unclear. All is resolved now, with the Mongolian government owning 34% of the mine and the $7B underground expansion now operational. Oyu Tolgoi is expected to produce 500,000 tonnes per annum of copper between 2028 and 2036, making it the fourth largest copper mine in the world. The project is the largest in Mongolia’s history, with a total cost of more than $17B (open pit cost $10B), and at one point it was estimated that the mine comprises a third of Mongolia’s GDP. Mining is a long game and megaprojects like this take decades to develop, often with multiple owners over the project’s life.

Geopolitics

EU Critical Raw Materials Act

The European Union proposed the Critical Raw Materials Act last week that would classify copper and nickel as critical minerals in an effort to revitalize supply chains of the metals vital to the energy transition. Though significant, many in industry are calling on the European government to go further and implement programs similar to the American Inflation Reduction Act, in which government loans and grants back up proclamations of the criticality of certain raw materials. Copper and nickel are both already widely used and produced for use in wires and stainless steel (respectively), but increased electric vehicle and battery adoption is leading to drastic increases in demand for the metals, pushing up prices. Additionally, the nickel market was shocked by the Russian invasion of Ukraine last February, which threatened to cut off a primary supplier (Russia) of nickel to the European market. While nickel is designated as a critical mineral in the US, copper is not yet, though many at the highest levels of government (including Senators Kyrsten Sinema and Mitt Romney) are pushing for its designation. The proposal still has to make its way through European Parliament, but is a step in the right direction if the EU wants to increase the resilience of its energy transition supply chains.

Key Takeaways

Zimbabwe’s effort to bolster domestic lithium processing is hurting smaller miners — similar moves have worked in the past, but they may have moved too quickly.

The London Metal Exchange’s nickel market had another speedbump, with the discovery of stones in bags supposed to contain nickel.

While Peru’s copper exports are down 20% year-over-year, there are dozens of projects in the pipeline expected to be commissioned in the coming years.

Copper mining capacity continues to come online, with the expansion of Ivanhoe’s Kamoa-Kakula and Rio Tinto’s Oyu Tolgoi mines.

Legislation is making its way through European Parliament to designate copper and nickel as critical minerals — this government support may help, but industry wants more action.