This Week in Critical Minerals – #16

Mining technology, copper, lithium, nickel, and uranium news

Technology

Epiroc signs $32.6M deal with Codelco. The deal is Epiroc’s largest yet for digital solutions, which include asset management, scheduling software, and visualization of personnel and equipment throughout mine sites. The software enhances safety at mine sites due to the ability to know where all employees are working and avoid collisions of equipment underground. It also improves the efficiency of operations with products such as on-site core logging, machine performance data collection, and continuous monitoring of production. This contract is for 5 years of services, with the first phase of $6.5M booked in Q4 2023.

Copper

Codelco to invest $720M in Chuquicamata. Located in northern Chile, Chuquicamata is one of the largest copper mines in the world, producing 268,348 mt of copper in 2022. Last Thursday, Codelco filed for a permit to adjust plans for the underground extension of Chuquicamata (which is currently just open-pit) at a cost increase of $720M. The expanded plans include two additional ventilation/electrical shafts, several more levels to the mine, and an access tunnel. The new underground mine would produce 140K mt of copper per year, a sorely-needed increase as Codelco’s production has fallen to a 25-year low.

Ivanhoe to restart Kipushi mine by mid-year. Ivanhoe has been constructing the Kipushi mine, located in the DRC near the Zambia border, for several years. Last week, the company executed an agreement made in February 2022 with Gécamines, the DRC state mining company. Under the agreement, an additional 6% control of Kipushi Corporation, the company in control of and operating the Kipushi mine, will be transferred to Gécamines, bringing their ownership to 38%. On January 25th, 2027, an additional 5% will transfer to Gécamines, leaving them with 43% control and Ivanhoe Mines with 57%. Finally, when 12 million tonnes (or at least today’s proven and probable reserves) have been mined and processed, Gécamines will get an additional 37%, leaving it at an 80-20 split. Kipushi is primarily a zinc mine today, though it was the richest copper mine in the world in the 1920s, with an average grade of 18%. Today, Kipushi has a measured and indicated resource of 11.78M tonnes grading 35.34% zinc, 0.80% copper, 23 g/mt silver, and 64 g/mt germanium. Construction at Kipushi is rapidly advancing, with the concentrator 79% finished and the ball mill and flotation cells being installed.

Taseko inks $50M royalty deal to fund Florence Copper project. Florence Copper is an in situ recovery project for copper in southern Arizona that is expected to come online in 2025. In the in situ recovery project, a low-pH solution is injected underground through wells into the orebody, which is naturally fractured and porous, allowing the solution to selectively dissolve copper and be pumped back to the surface, where it can then be recovered. Florence Copper will use 65% less energy and 78% less water than conventional open-pit mines in the region and will not require blasting, hauling, and crushing ore. Last week, Taseko signed an agreement with Taurus Mining Royalty Fund for $50M in exchange for a 1.95% royalty on revenue generated at Florence Copper. Along with recent financing from Mitsui, this allows Taseko to continue to advance construction at Florence Copper, with drilling of the wellfield commencing in February.

Lithium

Liontown cuts outlook on Kathleen Valley, Albemarle slows spending. On September 5th, 2023, Albemarle offered to buy Liontown Resources for A$3 per share, valuing the company at A$6.6B. Now, just four months later, Liontown is trading below a dollar. Liontown is developing Kathleen Valley, a hard rock lithium mine in Western Australia, with production expected to commence in the middle of this year. Last week, Albemarle sold its remaining stake in Liontown at a price of A$1.26 to A$1.32 and is decreasing capital expenditures in 2024 to just $1.6-1.8B, down from $2.1B in 2023 due to a worsening lithium price outlook.

Yesterday, Liontown released news that a A$760M loan has been pulled due to low spodumene (lithium) prices. This loan would have gone to mine construction and paying off another A$300M debt facility. To maintain construction with less funding, Liontown has deferred construction of a 4M tpa underground operation and has adjusted its mine plan. The company says they have enough cash to build the now smaller mine but does not seem to have a cash buffer and working capital to burn through during ramp-up before the company produces revenue. The big question here is how much more capital they need and who it will come from. One answer may be Australian billionaire Gina Rinehart, who owns 19.9% of Liontown and was responsible for blocking Albemarle’s takeover offer last fall. With hundreds of millions of dollars still at stake in Liontown and clear ambitions in Australian lithium (see Azure Minerals), she may be interested in acquiring more of the company at this steep discount or an even steeper discount in a few months if Liontown’s financial situation continues to deteriorate.

Nickel

Wyloo, First Quantum shut down WA mines. Wyloo Metals, a private company owned by Andrew Forrest, acquired Mincor Resources in July of last year for $760M, receiving several nickel mines in the Kambalda region of Western Australia adjacent to Wyloo’s Kambalda nickel concentrator. Now, amid collapsing nickel prices, Wyloo is putting their Western Australia nickel mines (Cassini, Long, and Durkin) into care and maintenance beginning on May 31 and has told BHP that they will not be able to fulfill their nickel offtake obligations. CEO Luca Giacovazzi told the Australian Financial Review in an interview last week that Wyloo wants to see bifurcated pricing between “dirty” nickel from Indonesia and Russia and ESG-friendly nickel from places like Western Australia. With higher standards for safety and pollution, Australian producers have higher costs than many producers overseas but are selling a product with a lower environmental impact. If downstream manufacturing and consumer-facing companies care about the environment, they will create a price incentive for mining companies to produce green nickel. Though with many layers to the supply chain and consumers insulated from the mining industry, this is a difficult prospect. Also last week in WA nickel, First Quantum Minerals announced that they would halt production for two years at the Ravensthorpe mine, in another blow to Western production of this vital commodity.

Uranium

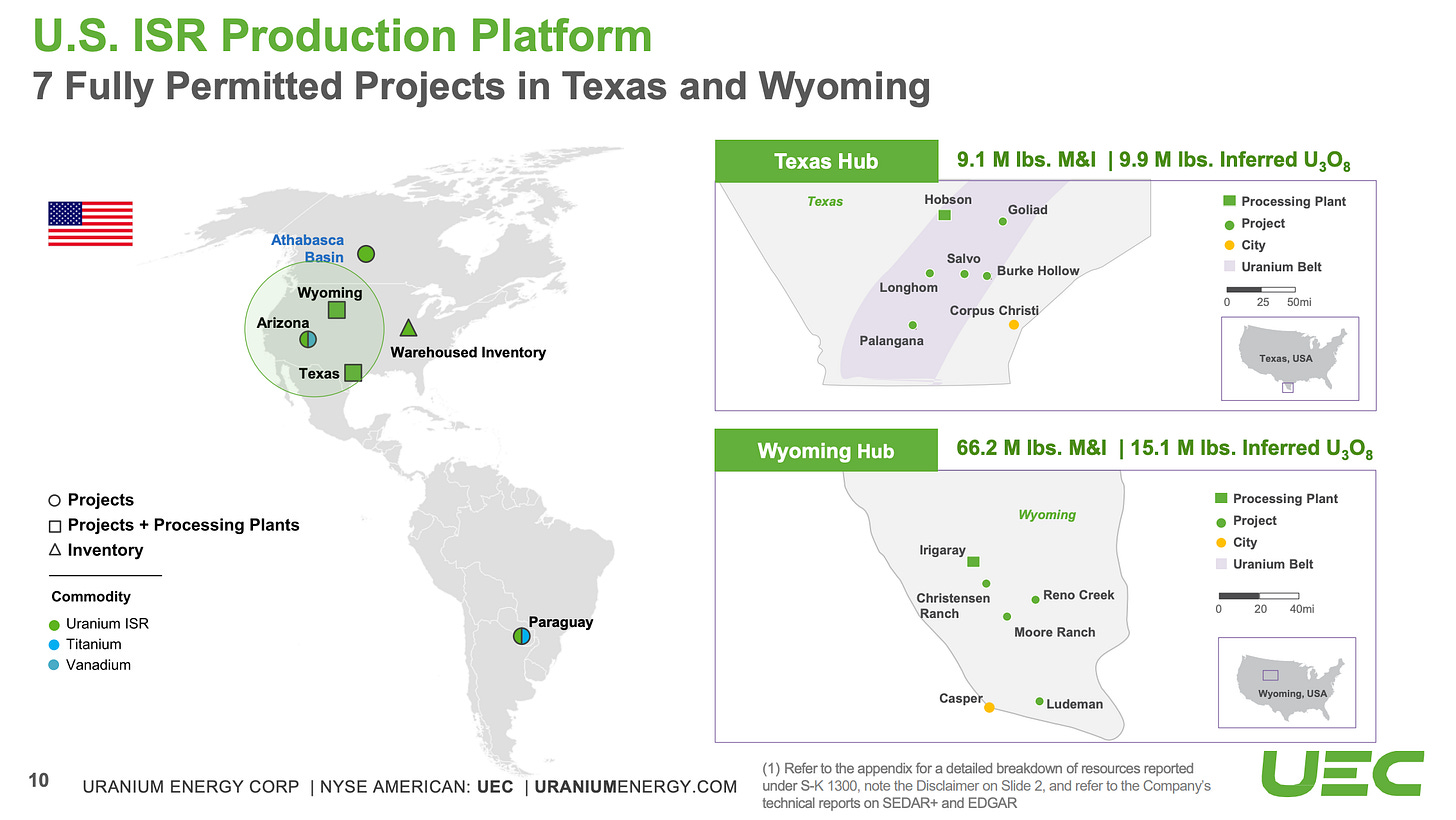

UEC to restart production in Wyoming. Uranium Energy Corp announced that their Board has approved restarting production at the Christensen Ranch in situ recovery (ISR) operation in Wyoming. The uranium produced at Christensen Ranch will be processed at the Irigaray Central Processing Plant, which has the capacity to process up to 2.5M lbs of U3O8 per year (~6.5% of US consumption in 2022) from four of UEC’s ISR operations nearby in Wyoming. First production is expected in August of this year. UEC is unique among near-term uranium producers due to its unhedged strategy, meaning 100% of the uranium produced at Christensen Ranch will be sold at the spot price. If the price remains anywhere near recent highs of $106, this operation will be highly profitable for UEC. UEC has seven fully permitted sites across Texas and Wyoming, with production expected to commence at many of them in the next year.