This Week in Critical Minerals – #13

Copper, lithium, cobalt, nickel, rare earths, and uranium news

Happy New Year! As we move into 2024, let’s dig into what happened in critical minerals mining in the last two weeks of 2023.

Copper

Antofagasta approves second concentrator at Centinela mine. Centinela produced 247,500 tonnes of copper in 2022, and the expansion will add an additional 144,000 tpa (as well as 130,000 oz/yr gold and 35000 tpa of molybdenum). The mine has a 36-year mine life with ore reserves of approximately two billion tonnes. The new concentrator is expected to cost $4.4B, including the concentrator plant, a new tailings facility, new autonomous mining equipment, an expansion to the Esperanza Sur pit, and additional infrastructure. Construction is expected to take 3 years, with commissioning expected in 2027. The expansion will move Centinela into the top 15 copper mines globally as Antofagasta progresses to hit its production target of 900,000 tpa of copper production (from 646,200 tonnes in 2022).

Antofagasta acquires 19% stake in Buenaventura. Buenaventura is the largest publicly traded precious and base metals miner in Peru, operating 7 mines and 6 exploration projects across the country and holding a nearly 20% interest in Cerro Verde, the 6th largest copper mine in the world operated by Freeport-McMoRan. The company produced nearly 116,000 tonnes of copper in 2022 (including its stake in Cerro Verde), with just over 29,000 tonnes from Buenaventura operations, as well as 206,000 oz of gold. Antofagasta operates four mines in Chile, and their only investment outside of Chile is the Twin Metals copper-nickel-cobalt-PGEs project in Minnesota. The new ownership stake in Buenaventura reflects Antofagasta’s ambition to invest in exploration across the Americas.

Argentine mining export taxes are unchanged; Milei looks to cut red tape. Newly-elected Argentine President Javier Milei announced a sweeping omnibus bill last week cutting regulations, bureaucracy, and tariffs across Argentina’s economy. Absent from these cuts, though, were changes to export duties on the mining and hydrocarbons sectors — the only sectors to remain unchanged. Argentina’s mineral export tariffs vary by commodity from 0 to 8% (4.5% for lithium). Many analysts are still bullish on Argentina’s mining industry due to a stated commitment by the mining ministry to quintuple lithium production to 250,000 tpa as well as streamline the permitting process for exploration and production.

NewRange wins minor legal permitting battle, long way to go. NewRange Copper Nickel is a 50-50 joint venture between Glencore subsidiary PolyMet and Teck developing the NorthMet and Mesaba deposits in the Duluth Complex of northern Minnesota. The Minnesota Court of Appeals recently affirmed the granting of an air emissions permit for the NorthMet project after the permit was challenged by a coalition including the Minnesota Center for Environmental Advocacy, Friends of the Boundary Waters Wilderness, and the Sierra Club. The permit was initially applied for in 2016, granted in 2018, and has been in a legal quagmire since. The coalition’s contention was that Glencore and Teck failed to properly disclose potential expansion plans for the mine when applying for the initial permit, while NewRange contends that they will apply for necessary permits when expansion plans are finalized. Though the air emissions permit now seems to be granted, NewRange faces myriad other permitting challenges. In 2018, the company was also granted a water quality permit, a federal wetlands permit, and an overall “permit to mine.” All three of these have since been revoked and are being disputed. NewRange (formerly PolyMet) is a classic example of permits being granted in the United States and then publicly challenged, with disputes lasting (now) half a decade or more. The lack of regulatory clarity and the financial burden this puts on the companies are part of why the United States is not considered a competitive mining jurisdiction.

IRH to invest $1.1B in Mopani Copper Mines. International Resource Holdings (IRH) is a natural resources-focused subsidiary of International Holding Company (IHC), an Abu Dhabi-based conglomerate with a nearly US$240B market cap. IHC has been chaired by Sheikh Tahnoon bin Zayed al-Nahyan, brother of UAE president Sheikh Mohammed bin Zayed al-Nahyan, since 2020, and he controls Royal Group, which owns 62% of IHC. Mopani has been producing copper in northern Zambia (near the DRC border) since the 1930s, and the company assets include several underground mines, concentrators, a smelter and a refinery. Mopani was sold by Glencore (and minority owner First Quantum) to Zambia Consolidated Copper Mines Investments Holdings (ZCCM-IH), an entity controlled by the Zambian government, in 2021 for $1.5B funded by debt. The deal announced recently has IRH buying 51% of Mopani from ZCCM-IH for $1.1B, which will be used to pay down the debt owed to Glencore, with $300M of it used to fund mine expansion. Mopani produced 72,694 tonnes of copper in 2022 and, with expansion plans, aims to produce 200,000 tpa by 2026.

Lithium

SQM and Hancock offer to buy Azure for A$1.7B. Chilean chemicals giant SQM and Australian miner Gina Rinehart’s Hancock Prospecting offered a joint bid of A$3.70 per share for Azure Minerals, an Australian lithium exploration company. SQM and Hancock already own a combined 37.8% of Azure shares (~19% each) and have received the approval of major shareholders Creasy Group (12.8%) and Delphi Group (10.2%) for the proposed scheme of arrangement. Separate from SQM and Hancock, Australian mining billionaire Chris Ellison’s Mineral Resources has been accumulating shares in Azure over the past few months up to a current level of 13.6%, presumably with the intention of taking part in Azure’s projects (potentially offering a bid). The proposed scheme throws a wrench in these plans, as SQM and Hancock offer to buy out MinRes and other shareholders. Since SQM and Hancock cannot vote in the scheme, MinRes’s stake represents ~22% of the votes, and 75% is required for the scheme to pass (with absent voters, this may equal a blocking stake). In the event MinRes declines the offer, SQM and Hancock have also offered an off-market takeover bid at A$3.65 per share. MinRes has not yet indicated if they are willing to accept the scheme, and the dramatic Australian lithium M&A saga will continue through the new year.

Allkem shareholders approve $10.6B merger with Livent. In May 2023, lithium producers Allkem (Australian) and Livent (American) proposed a merger of equals, valuing the combined entity at $10.6B. The final stage of this process has now concluded, with 72% of Allkem shareholders (90% of votes cast) voting to approve the scheme. The combined entity, now known as Arcadium Lithium, will be the third-largest lithium producer in the world (after SQM and Albemarle). The deal is expected to close on January 4, and the companies will begin operations as a combined entity.

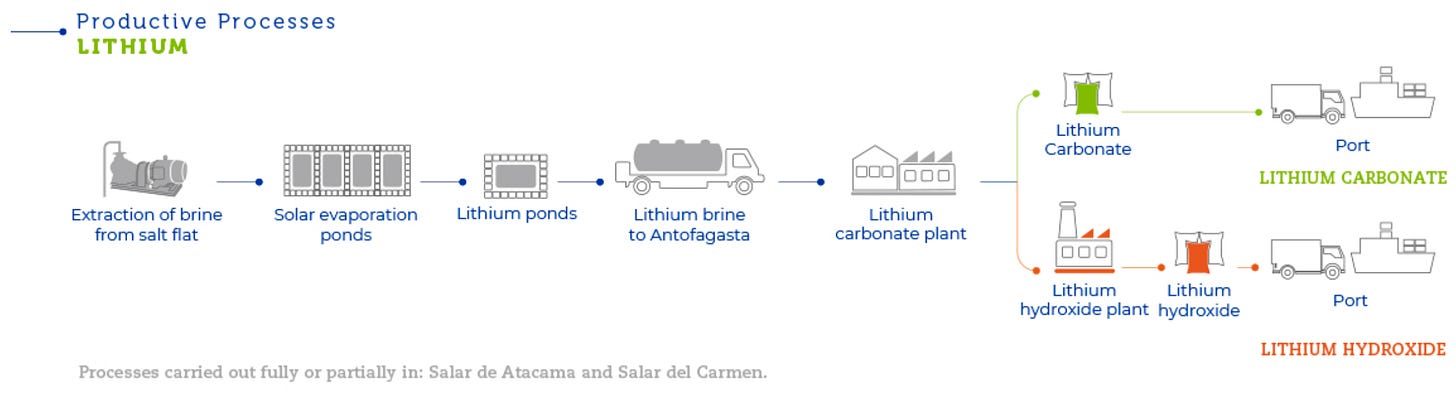

Codelco and SQM reach an agreement on a government-controlled partnership. Codelco is the Chilean state-controlled mining company that primarily mines copper, but earlier this year, indicated an appetite for involvement in the country’s lithium sector. The agreement outlines SQM’s operations on the Salar de Atacama from 2025 to 2060. The agreement will create a new company (NewCo) starting in 2025, with Codelco owning 50% plus one share and SQM owning 50% minus one share. SQM will contribute all their lithium production and refining assets in Salar de Atacama, their knowledge, employees, and distribution network. Codelco will contribute their mining lease on the salar (brine pond) from 2031 to 2060 (SQM’s lease expires in 2030) and a significant increase in the company’s production quota beginning in 2025. SQM will maintain operational control of NewCo and the majority of the profits through 2030, when Codelco gets to nominate additional directors to the board and an equal split of economic benefits commence. Including the lease agreements and taxes, nearly 70% of the operational profits of the lithium operations accrue to the Chilean state.

Cobalt

US Strategic Metals announces $230M financing from Appian. US Strategic Metals is developing a mineral processing and recycling plant in Fredericktown, Missouri to produce battery-grade nickel and cobalt, as well as precursor cathode active material, a key component of batteries not currently produced at scale in the US. The company, formerly known as Missouri Cobalt, is also developing a cobalt-nickel mine. The capital will fund the development of a mine at this former superfund site. USSM has raised nearly $500M in funding to date, and they signed a marketing agreement with Glencore last year. The completed phase-one plant will be able to handle 240 tons of feedstock per day, which could include “recycled lithium-ion batteries, battery production scrap, mixed metal concentrate, and traditional ore,” making it the only fully-permitted facility of its kind in the US.

Nickel

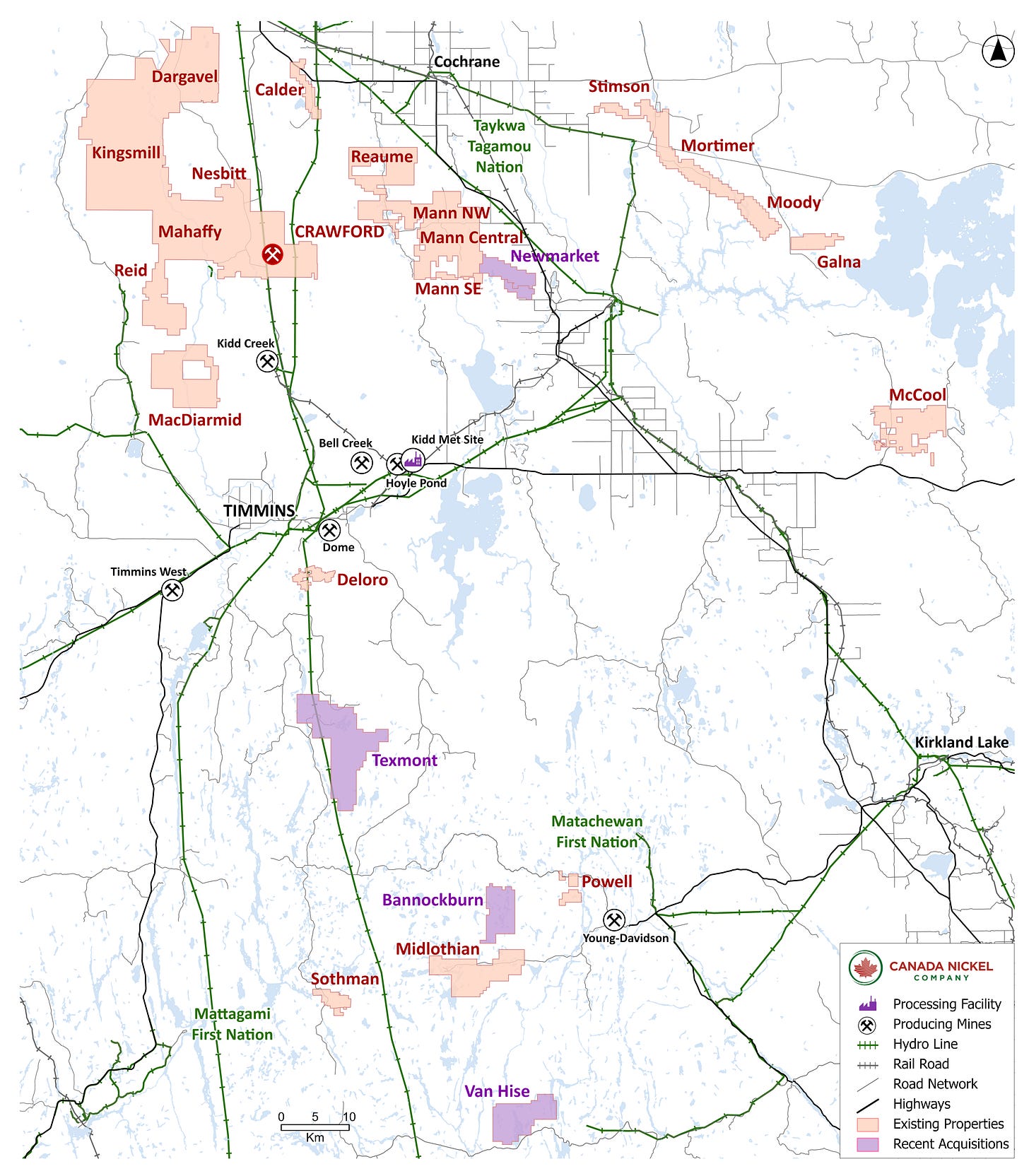

Agnico Eagle invests C$23.1M in Canada Nickel. Agnico Eagle is a major Canadian gold and silver producer with operating mines in Canada, Australia, Finland, and Mexico. Following fellow gold majors Barrick and Newmont getting involved in copper mining, Agnico Eagle is joining the critical minerals space by investing in Canada Nickel. Canada Nickel is exploring at the Crawford project, which contains multiple properties in the Timmins Nickel District in Ontario. For each of the 19,600,000 shares Agnico Eagle purchased for C$1.18, they also receive a 0.35 of a warrant with a strike price of C$1.77. If all warrants are exercised, Agnico Eagle’s ownership stake will rise to 15.6%, with the right to maintain pro rata in future equity raisings.

Rare Earths

Serra Verde receives environmental approval for Brazil mine. Serra Verde is developing the Pela Ema rare earths deposit in central Brazil. Last week, the company received the environmental operating license from the Goiás state government, the final approval necessary to commence production at Phase I of the project. Pela Ema phase one will produce approximately 5000 tpa of rare earth oxides (~1.6% global production) over a 25-year mine life, with a potential Phase II expansion being investigated by the company. Production should start early next year. The company has offtake agreements secured for most of its planned production. Ex-China rare earth processing capacity is still nascent, so these agreements will likely result in the Brazilian REEs being shipped to China. The deposit is ionic clay, so it is located near the surface and can be mined without hazardous chemicals, resulting in less environmental impact than larger conventional projects.

China to ban export of rare earths technology. The People’s Republic of China’s Ministry of Commerce released the Catalog of China's Export Prohibited and Restricted Technologies, a list of export restrictions of technology deemed critical to the national security of the PRC. This list is continuously updated, most recently in 2020, and a draft of what was released last week was initially announced on 30 December 2022 (so the list really should not come as a surprise). The updated list follows tightened export controls of gallium, germanium, graphite, semiconductor technology, and many other high-tech items over the last year and includes the following rare earths-related items:

Prohibited

Rare earth extraction and separation technology

Production technology of rare earth metals and alloy materials

Preparation technology of samarium cobalt, neodymium iron boron, and cerium magnets

Preparation technology of rare earth calcium oxyborate

Restricted

Ionic rare earth mine leaching process

Mining of rare earths, mineral processing, and smelting technology

Synthesis process and formula of rare earth extractants

Rare earth modification and addition technology of metal materials

Prohibited technologies may not be exported, while restricted items need to be licensed. It seems that China wants to keep magnet manufacturing technology close to home while allowing their state-affiliated companies to extract rare earths outside China, predominantly in Southeast Asia (Myanmar, Vietnam, Thailand). A translated version of the document can be found here.

Uranium

Energy Fuels to restart five mines in response to surging prices. Energy Fuels is a leading US uranium producer also developing rare earths refining capabilities. The company has commenced production at the Pinyon Plain, La Sal and Pandora mines, ramping up production by the end of 2024, to be producing at a run rate of 1.1 to 1.4 million pounds per year. This uranium will be stored, to be processed at the company’s White Mesa Mill in Utah in 2025 and later. The Whirlwind and Nichols Ranch mines are being prepared to commence production later this year, as the company expects to ramp total production to 2 million pounds by the end of 2025, assuming strong market conditions and government support continue.

Bannerman receives final permits for Etango project. Bannerman Energy, an Australian uranium development company, received the permit to mine at their Etango project in Namibia in mid-December 2023 and is now commencing construction. Etango’s definitive feasibility study, completed in December 2022, indicates 3.5M lbs/year uranium concentrate (U3O8) production at a cash OPEX of US$35/lb (excluding royalties). Etango will be an open pit mine using heap leaching to extract the uranium, and production should begin in 2026. Namibia is the third-largest producer of uranium in the world, with two existing mines, Rossing and Husab, controlled by Chinese investors. Australian Paladin Energy aims to restart its Langer Heinrich mine early this year.

Love that this is coming back!

Great newsletter, Ted! Thanks for sharing!