This Week in Critical Minerals – #15

Mining technology, copper, lithium, nickel, rare earths, graphite, and uranium news

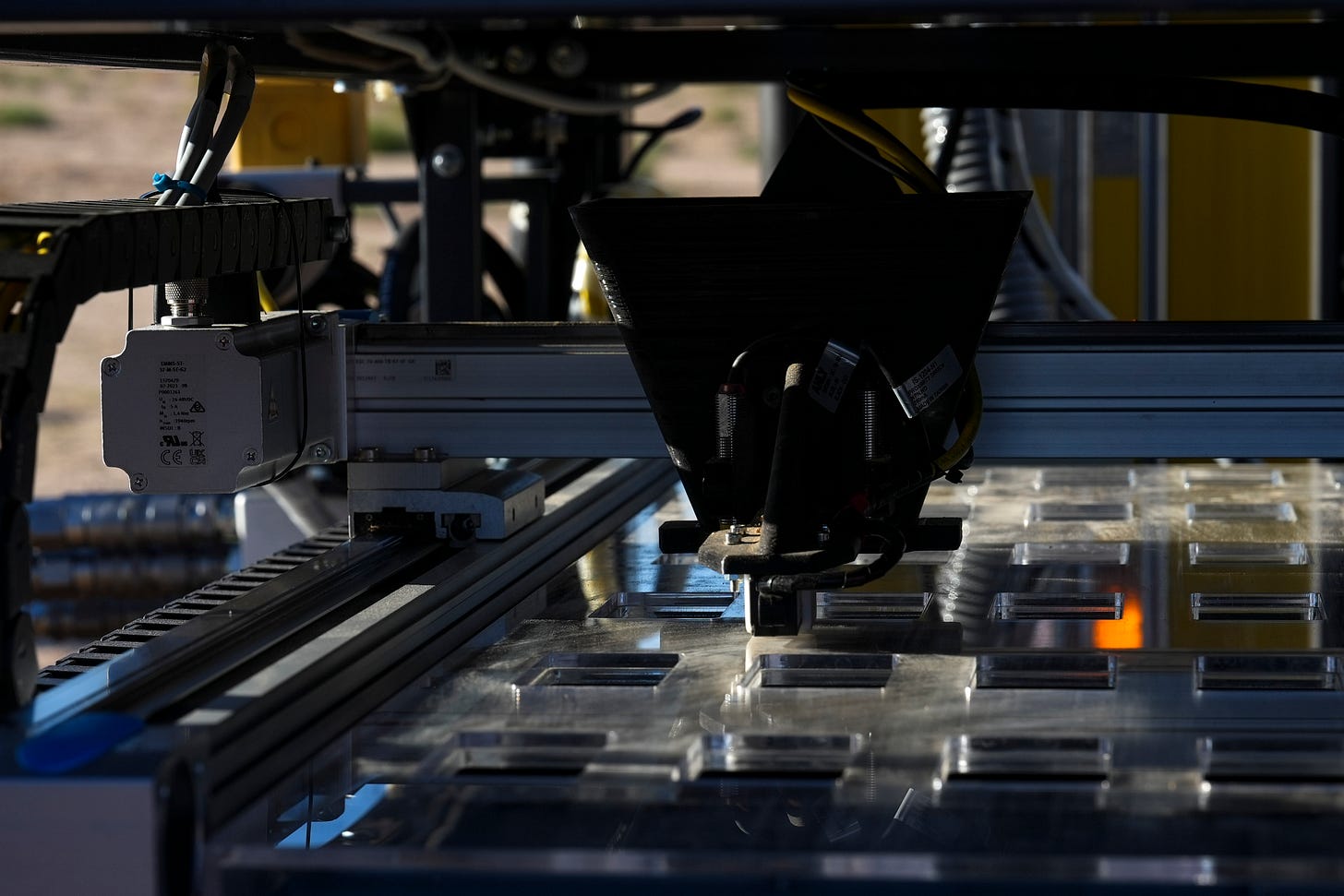

Technology

ERG Arabia introduces autonomous soil sampling robot. ERG Arabia is a subsidiary of Eurasian Resources Group, established last January with a $50M investment focused on creating a mining technology hub based in the Kingdom of Saudi Arabia (KSA). Last week ERG Arabia introduced NOMAD, an autonomous rover used to collect up to 120 soil samples per day with minimal human guidance. The autonomous system also includes a mobile base station with the ability to recharge several of the sampling robots. The system has all-wheel drive, allowing for easy transit across the Kingdom’s rugged desert terrain, a drill to collect samples up to 80 cm deep, and a host of sensors for on-board sample analysis, including x-ray fluorescence (XRF) and hyperspectral. The project has been several years in the making and was developed in collaboration with Chilean robotics company Godelius. Field testing of the units in KSA began in December, and ERG estimates the autonomous sampling is a 4X speedup compared to manual collection.

Epiroc inks partnership with Vale, tests electric drill rigs. This past week Epiroc signed a non-binding MoU with Vale Base Metals subsidiary Vale Canada “to develop, test and utilize groundbreaking mining techniques and equipment to strengthen safety processes and drive innovative mining solutions while enhancing productivity.” While this is just a press release laden with buzzwords, this partnership will likely see Epiroc’s breakthrough drilling and underground mining equipment tested and deployed early at Vale Base Metals sites across Canada in the near future. Epiroc is focused on electrifying its fleet of mining equipment, and Vale Base Metals has many operations in Canada, a country where decarbonization is a political priority, thus a rush for Vale to deploy new technology. Also announced recently, Epiroc is field-testing their battery-electric SmartROC D65 BE drill at Capital Limited’s operations across Africa in 2024. Epiroc is aiming to be one of the first companies to introduce a battery-electric drill rig to the market, and field testing indicates they are close to doing so. As with any electric vehicle, charging in remote exploration locations is an issue, so these will likely be limited to existing mine sites with reliable renewable power if there is to be any environmental benefit.

Copper

Manara to start trading arm, potentially acquire stake in Reko Diq. Manara Minerals is a joint venture established last year between Ma’aden (the Saudi state mining company) and the Public Investment Fund (PIF) to invest in mining assets across the globe. Manara made a splash last year when it acquired 10% of Vale Base Metals for $2.6B just months after the firm was founded. Manara (and Ma’aden) CEO Bob Wilt was interviewed at the Future Minerals Forum on Thursday that he envisions Manara having a trading arm given the need to manage the fund’s offtakes from its investments. This offtake would likely be sold to Saudi and foreign companies with downstream operations in the Kingdom, given KSA’s ambitions to become a mineral processing hub. In the same interview, Wilt noted that Manara is in discussions over a purchase of part of Reko Diq, one of the largest undeveloped copper-gold projects in the world owned by Barrick and the Pakistani government that is expected to commence production in 2028.

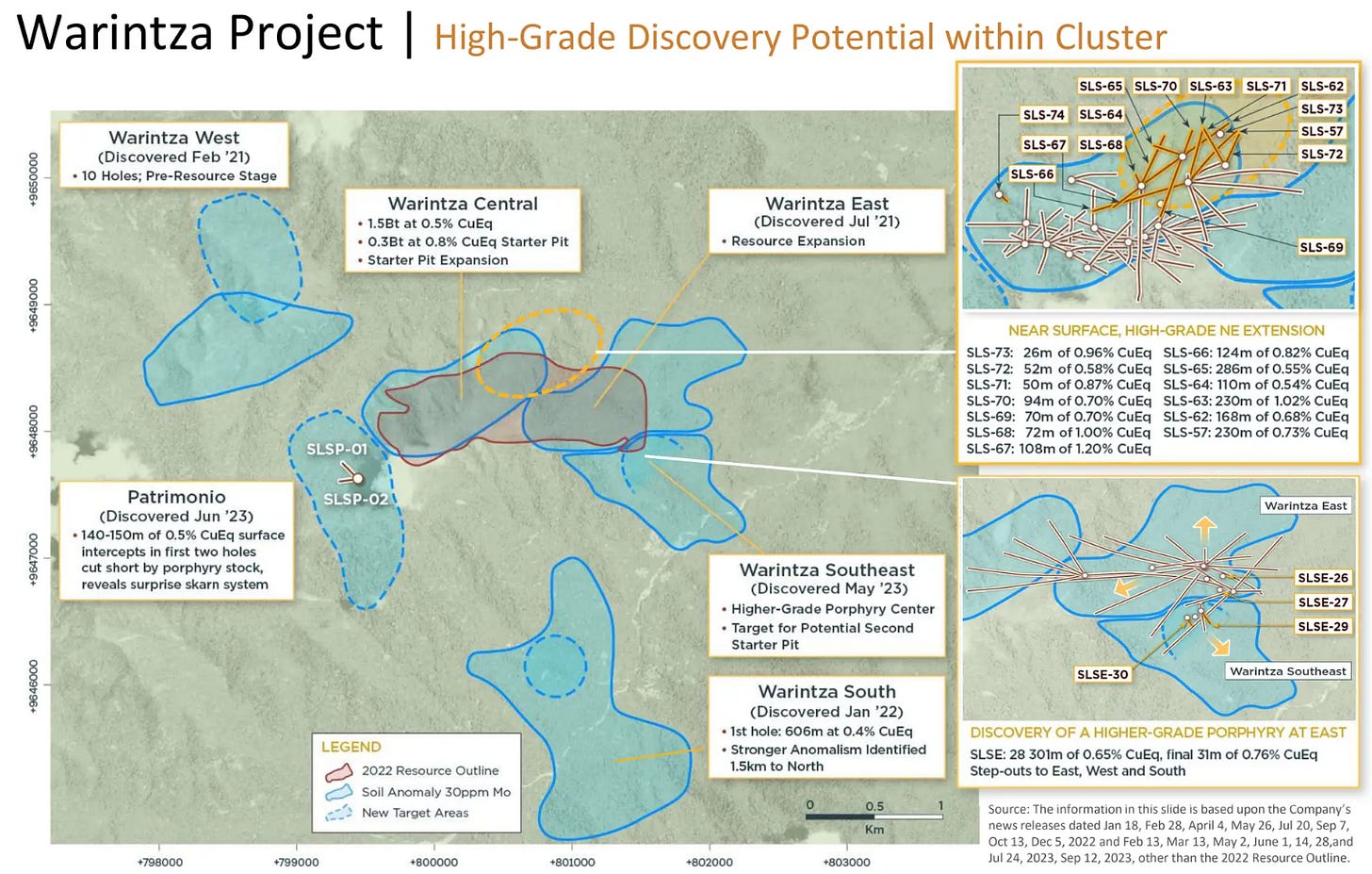

Zijin to invest $130M for 15% of Solaris. Zijin Mining is one of the largest Chinese mining companies (~$43B market cap) with operations across the globe, primarily focused on copper and gold. Solaris Resources is advancing a portfolio of projects across South America, most notably the Warintza Cu-Au-Mo project in Ecuador. Warintza was discovered by famed geologist David Lowell in 2000, though works broke down due to issues with the neighboring community. These issues were resolved by Solaris a few years ago, and the company delivered a resource estimate in 2022 with an indicated resource of 579 Mt of copper at a 0.47% grade (0.59% CuEq). The company plans to deliver a new resource estimate later this year, likely followed by a pre-feasibility study in 2025. Solaris is part of the Augusta Group, a mining-focused management group that has a track record of successful acquisitions of its exploration and development companies. Most recently, in 2018, Augusta Group member Arizona Mining was acquired by South32 for $1.8B.

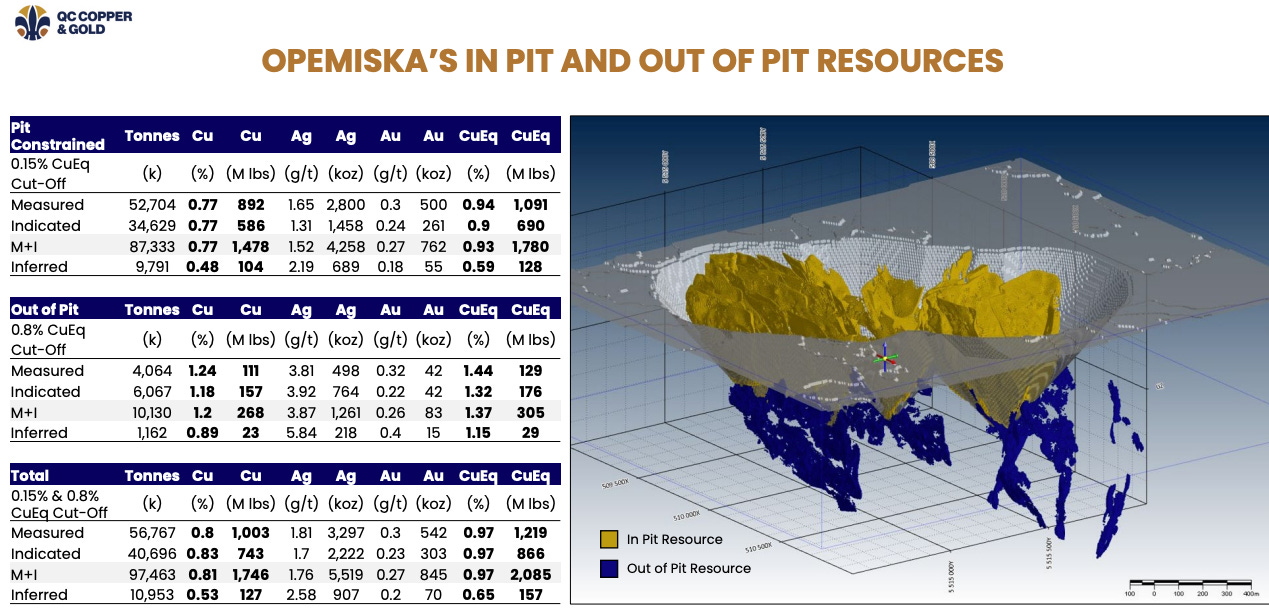

QC Copper updates resource to nearly 2B lbs. QC Copper released an updated mineral resource estimate (MRE) for the Opemiska project in Quebec. The MRE outlines a measured and indicated resource of 1.75B lbs of copper, 845K oz of gold, and 5.5M oz of silver, approximately 85% of which are within the bounds of a proposed open pit mine. At a grade of 0.77% copper (0.93% CuEq), the Opemiska pit would be the highest grade open-pit copper mine in Canada, though with a substantially smaller total resource than larger projects like Teck’s Highland Valley Copper project with a measured and indicated of 2.5B lbs of copper. Opemiska is built around two former copper-gold mines, Springer and Perry, closed by Falconbridge in 1991. The mineral resource estimate includes data from a 2021 20,000 meter drilling campaign as well as re-evaluations of old Falconbridge drilling and geological data, in total evaluating more than a million meters of drilling and approximately 350,000 assays. QC Copper plans on releasing a preliminary economic assessment (PEA) later this year.

Supreme Court dismisses Pebble appeal. Pebble is one of the largest undeveloped mines in the United States, which, if built, would churn out 6.4B lbs of copper, 7.4M oz of gold, 300M lb of molybdenum, 37M oz of silver, 200K kg of rhenium over a 20-year mine life. Located in Alaska and owned by Northern Dynasty Minerals, the company has struggled to receive environmental permits with the backdrop of fierce community and political opposition. This culminated in the January 2023 EPA decision to block Northern Dynasty from storing mine waste in the Bristol Bay watershed using authority granted by the Clean Water Act. Alaskan lawmakers, including Attorney General Treg Taylor, filed an appeal to the Supreme Court to get them to reverse the EPA’s decision last July. Last week the Supreme Court dismissed this request for an appeal, seemingly ending a last-ditch effort to keep the Pebble project alive. Northern Dynasty claims they will try other legal options, but in the eyes of shareholders, this was a major blow for the company, with the stock dropping nearly 40% on the news.

Ivanhoe Mines reaches 2023 guidance, expects higher for 2024. Under the backdrop of the Future Minerals Forum in Saudi Arabia, Robert Friedland and Ivanhoe Mines have announced that Kamoa-Kakula met 2023 production guidance, producing 393,551 tonnes of copper (contained in concentrate), within the target range of 390K to 430K tonnes. This represents an increase of 18% compared with last year, with the concentrators processing 8.5M tonnes of ore at an average grade of 5.2%. Ivanhoe is planning on commissioning a third concentrator in Q3 of this year, pushing up the 2024 production guidance to 440-490K tonnes (a 12 to 20% increase). This news bumps Kamoa-Kakula up the rankings to the seventh largest copper mine1 in the world by production. If next year’s guidance is met, the mine will climb even higher to the number three or four spot, behind only Escondida, Collahuasi, and El Teniente.

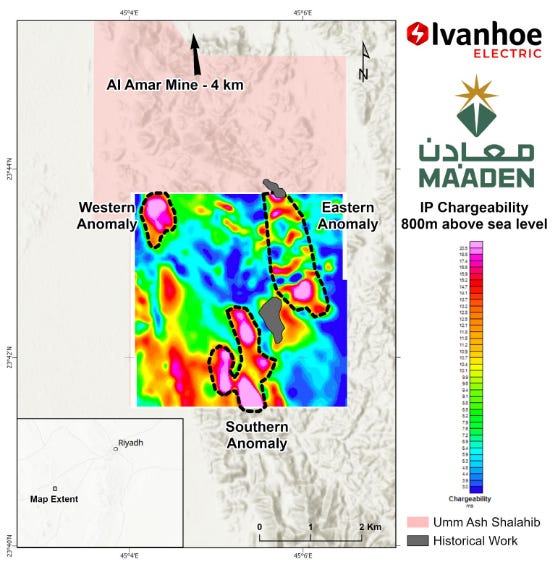

Ivanhoe Electric finds copper with Ma’aden, drills 25,000 meters. Friedland’s other major venture, Ivanhoe Electric, a technology and exploration company with projects in the United States and Saudi Arabia, announced an update to their joint venture with Ma’aden at the Future Minerals Forum. Using Ivanhoe’s Typhoon chargeability surveying system, the partnership has found three chargeability anomalies. Chargeability is a geophysical surveying technique and property of subsurface materials describing its ability to become polarized when a current is applied (related to conductivity, and useful for finding metals like copper). The southern anomaly lines up with Ma’aden drill results from the area in 2018, indicating 31.5 meters at 2.98% copper, while the western anomaly is an entirely new discovery. These initial surveys focused on the Al Amar belt, a subsection of the 48,500 square kilometers available to the JV that is highly prospective for volcanic massive sulfide deposits. Ivanhoe’s technology is supposedly better than others at finding chargeability anomalies at great depth, but the exact scope of these discoveries will only truly be known when the company can get drill rigs in the field to test it. Ivanhoe Electric also announced that it has drilled 25,000 meters across 37 holes at its Santa Cruz project in Arizona during the past four months, including a 66-meter section at 2.85% copper. The program included both infill and step-out drilling as the company works to expand the resource model to deliver a pre-feasibility study by the end of Q2 2025.

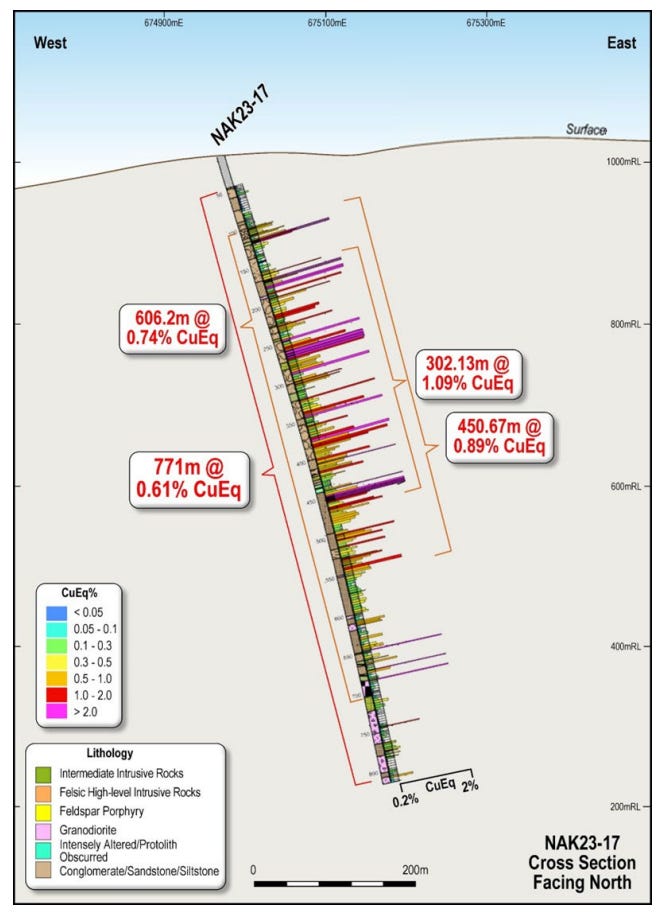

American Eagle intersects 302 m at 1.09% CuEq. American Eagle is developing the NAK Cu-Au-Mo project in British Columbia and is partnered with Teck, who owns 19.9% of the company. In their last drill-hole of 2023 (NAK 23-17), American Eagle drilled their best results to date, including 302 m at 1.09% CuEq (0.4% Cu, 0.53 g/t Au, 1.2 g/t Ag, 431.4 ppm Mo) within 606 m of 0.74% Copper Eq beginning 98 m downhole. This hole was located 250 m west of any hole previously drilled, a significant step-out and opening up a new area of the deposit for further exploration. In 2024, the company’s focus is on another major drilling campaign (fully funded due to Teck’s investment) exploring targets around NAK 23-17 as well as untested targets to the northwest and northeast that are prospective based on their geophysical data.

Lithium

Roadblock at SQM lithium operation, production halted. Last week, around 500 protesters blocked a road to the Atacama salt flats in northern Chile, a hub for lithium production with operations owned by SQM and Albemarle. While Albemarle was relatively unaffected, SQM was the target of the indignation of the local indigenous communities, who are upset they were not consulted prior to the sweeping agreement struck recently between SQM and Chilean state-owned company Codelco. The roadblock lasted several days and forced SQM to suspend operations for a short while until it was agreed that Chilean President Gabriel Boric would visit the area, though the timing of this visit is as yet unclear. SQM is resuming operations on Monday, January 15th.

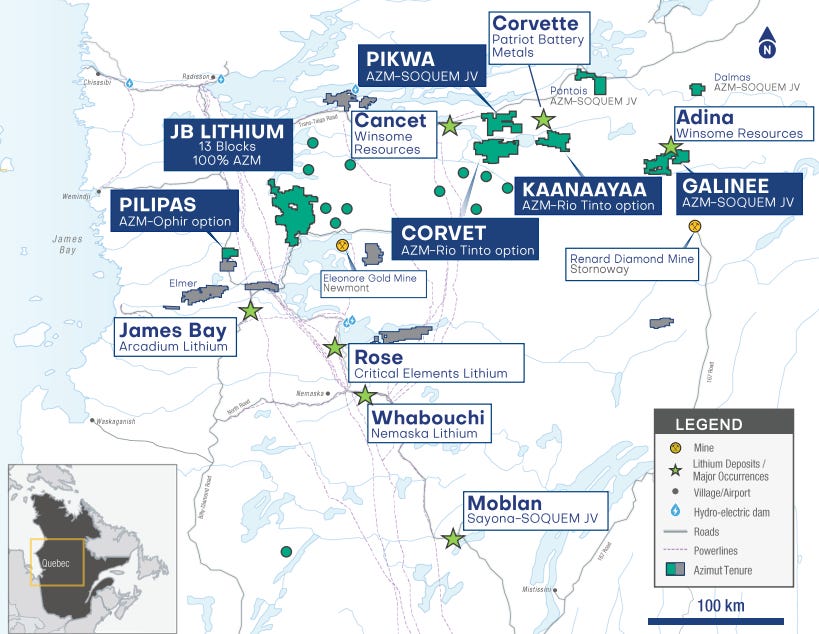

Azimut and SOQUEM drill 72.7m at 2.48% Li2O at Galinée. Galinée is a 50-50 joint venture between Azimut Exploration and SOQUEM located in the James Bay region of Quebec, an area highly prospective for lithium. The recent discovery is located at the northern part of the Galinée property, directly adjacent to the Adina property owned by Winsome Resources, which delivered a resource estimate in December 2023 of 59M tonnes of Li2O at 1.12%. The Azimut-SOQUEM JV also owns the Pikwa property along the Corvette trend, between major lithium discoveries made last year by Patriot Battery Metals. James Bay is the region to watch for lithium exploration in Canada, as discoveries like this one continue to prove out.

EMP Metals releases PEA for Viewfield lithium brine project. The Viewfield brine project is located in Saskatchewan and plans to encompass production from wellbores, direct lithium extraction from the brine, and conversion to a battery-grade chemical. The PEA highlights a plan to extract 12,175 tonnes of lithium carbonate equivalent over a 23-year project life, resulting in an NPV of $1.49B and an IRR of 55%. Production will occur from seven target zones at an average concentration of 128 mg/L of Li. EMP Metals has partnered with Koch Technology Solutions as its partner for direct lithium extraction (DLE). Koch is partnering with several other companies to deploy its Li-Pro DLE technology, including Standard Lithium and Grounded Lithium. EMP Metals expects first production in Q1 2027.

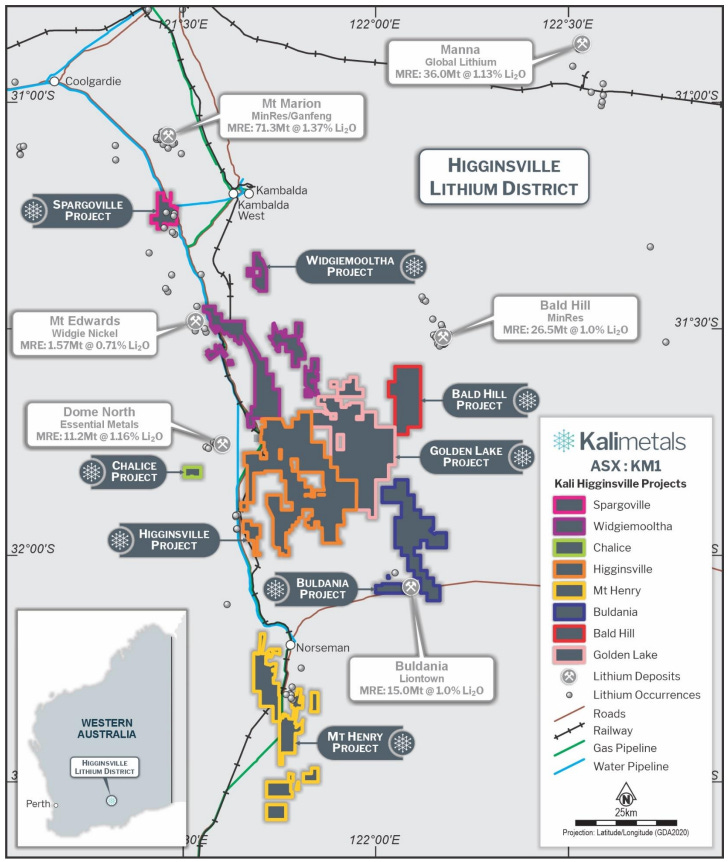

MinRes buys 10% of Kali Metals, spodumene discovered. Kali Metals is an Australian lithium explorer who debuted on the ASX last Monday. MinRes promptly acquired 9.97% of the company at an average price of A$0.43. The stock rocketed up to a peak of A$0.89 last week after announcing the discovery of spodumene in rock chip samples in several of the company’s properties in the Higginsville Lithium District in Western Australia. This area is home to Mount Marion, a major lithium mine jointly owned by Ganfeng and MinRes. Following the 250% increase just days after the public listing, Kali’s stock has crashed down to earth and is now at A$0.52 at the time of writing.

Promising ramp-up at Caucharí-Olaroz. Lithium Argentina released production results for Caucharí-Olaroz last week, revealing that the brine project exceeded production guidance of 5000 tonnes for 2023, producing approximately 6000 tonnes of lithium carbonate. Caucharí-Olaroz is in the midst of a ramp-up, with the lithium carbonate plant operating at just 50% capacity. Lithium Argentina is focused on achieving nameplate capacity in 2024. Caucharí-Olaroz is a joint venture with Ganfeng and Argentinian energy company JEMSE, and it is the largest greenfield brine project to come online in the last 20 years.

Nickel

Vale Base Metals wants to merge Sudbury nickel operations with Glencore. Vale Base Metals operates one of the largest integrated mining complexes in the world in Sudbury, Ontario, containing five mines, a mill, a smelter, nearly 4000 employees, and producing nickel, copper, cobalt, platinum group metals, gold, and silver. Glencore also has significant operations in the region, with their Integrated Nickel Operations including the Nickel Rim South mine (whose mine life ends this year) and the Onaping Depth project, an extension to the Craig mine that will extend the copper-nickel operations down to nearly 1.5 kilometers. During an interview with Reuters, Vale Base Metals Chairman Mark Cutifani discussed that finding a deal to merge their Sudbury operations with Glencore would be a priority in 2024. Expanding the already massive mining complex would create further operational efficiencies and cut costs for the company.

Samsung SDI to invest $18.5M for 8.7% of Canada Nickel. In addition to the equity stake, Samsung SDI, the battery manufacturer partly owned by Samsung Electronics, also has the right to purchase a 10% interest in the Crawford nickel project for $100.5M once a decision to proceed with the construction of the mine is final. Exercising this option will grant Samsung SDI access to 10% of the offtake from Crawford for the life of the mine, as well as an additional 20% offtake for 15 years. Located near Timmins, Ontario, Crawford is one of the largest nickel projects in the world, with proven and probable reserves of 3.8 million tonnes of contained nickel outlined in last November’s feasibility study. Just a week prior to the Samsung SDI deal, Agnico Eagle purchased a 12% stake (15.6% if warrants exercise) in Canada Nickel for $C34.7M.

Rare Earths

Defense Metals to ship mixed rare earth carbonate sample to Ucore. Defense Metals, a member of Discovery Group, is developing the Wicheeda rare earths project in British Columbia with a measured and indicated resource of 34.2M tonnes of rare earth oxide at 2.02% grade. If built, Wicheeda could produce 20,000 tonnes per annum of rare earth oxide, putting it at a similar scale to Lynas’s Mt Weld mine in Australia, one of only a handful of rare earth mines in the western world. The release of a pre-feasibility study is targeted for the first half of this year. As part of the feasibility studies, Defense Metals is investigating downstream processing of its rare earth material, including last week’s announcement of its MoU with Ucore. Ucore has developed RapidSX, a modular rare earth separation technology being piloted at the company’s demonstration facility in Kingston, ON. Defense Metals is sending Ucore a mixed rare earth carbonate sample produced by prior flotation pilot plant test work on a 26-tonne bulk sample extracted from Wicheeda last year. A Defense-Ucore alliance could result in the production of separated rare earths fully independent of China, a feat MP Materials only recently accomplished.

Graphite

Graphite One summer drill results indicate high-grade mineralization. Graphite One is developing the Graphite Creek project in Alaska with the aim to mine, process, and manufacture coated spherical graphite required for lithium-ion battery anodes. The company released a preliminary feasibility study in October 2022 detailing a $1.9B pre-tax NPV for the project and a 26-year mine life. As part of work towards a feasibility study (to be released Q4 this year), Graphite One’s summer 2023 drill program results were released, including a highlight of 9.40 m of 13.87% graphite just 10.36 m below the surface. All 52 holes encountered mineralization, further confirming the scale of what the USGS named last year “the largest known flake graphite resource in the USA.”

Uranium

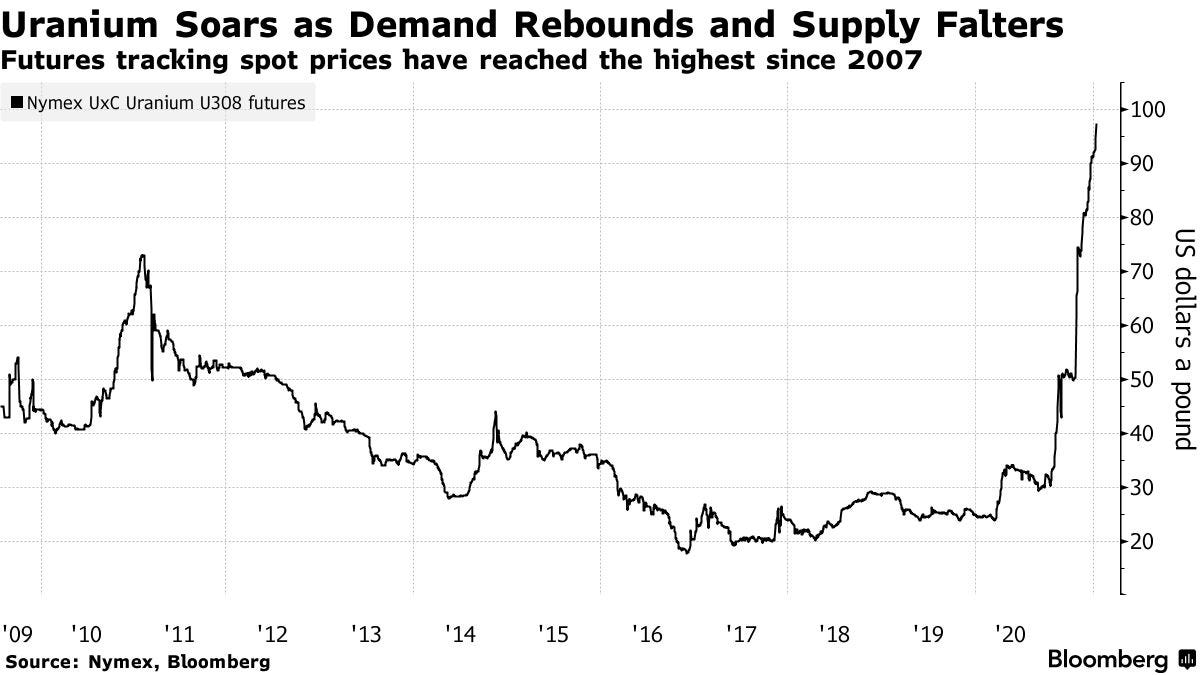

Kazatomprom expects production shortfall, price breaks $100. Kazatomprom, Kazakhstan’s state uranium company, is the largest producer of uranium in the world, responsible for more than a third of uranium mined in 2022. The company announced on Friday that they are likely to miss their production targets for the next two years due to shortages in sulfuric acid (used to leach uranium from ore) and construction delays at new deposits. With 2022 uranium production at only 74% of global demand, and with countries all over the world rapidly expanding their nuclear power usage, any additional shortage can contribute to rapid upward price movement. Though established players like Cameco and Energy Fuels are scrambling to restart mines, and new ones like NexGen are bringing new deposits into production, anything in the mining industry takes time, so the uranium price is going to remain high and volatile while these shortages persist.

DoE to invest $500M for high-assay low-enriched uranium (HALEU). HALEU is uranium enriched to 20%, historically used for medical devices but is now emerging as the fuel of choice for many advanced small modular reactors (SMRs) coming to the market over the next decade. Conventional nuclear reactors use uranium enriched to just 5%. $500M was allocated in the Inflation Reduction Act to source HALEU domestically, as the United States currently produces none. In fact, TENEX, a part of Russian state-owned Rosatom, is the sole producer of HALEU at a commercial scale. One company, Centrus Energy, is currently producing HALEU at demonstration-scale and could increase production if needed. Because enriched uranium is heavily regulated, and every producer in the US is required to get a license (through a rigorous process), the federal government needs to invest enough money to demonstrate to companies that there is a market and political support for their HALEU production.

Not all companies have released 2023 production, so this ranking assumes other top mines have not substantially increased production from 2022 to 2023.

This is fantastic. Great work, Teddy!

Great reporting!