This Week in Critical Minerals - #11

Albemarle earnings, Saudi investment, Nigerien uranium, and more

Welcome to the eleventh issue of This Week in Critical Minerals, where I cover the mining and resource processing projects and technologies being built worldwide. Let’s dig in.

Albemarle earnings, DLE play, and investment in Patriot

Albemarle reported its Q2 earnings last week, with sales growth of 60% to $2.4B and net income growth of 60% to $650MM. Albemarle is the world’s top producer of lithium chemicals, operating mines and brine ponds in the US, Australia, and Chile. The company attributes the drastic increase in sales to the bounceback in lithium prices over the last six months, resulting in 2023 prices being significantly higher than in 2022. Though they reported stellar earnings, the company’s stock has been down since last week, following news that they had reached a $218.5MM settlement to resolve possible violations of the US Foreign Corrupt Practices Act. The settlement would resolve the company’s voluntary disclosure in 2018 following an internal investigation that revealed improper payments made by representatives of its refining solutions business. Albemarle also disclosed the actions to Dutch authorities, but the Dutch took no action against the company.

In the past week, Albemarle also announced two primary potential sources of growth for the company, including an $83MM investment for 5% of Patriot Battery Metals, a Canadian developer with the Corvette lithium project in James Bay, Quebec. While a significant source of supply, Albemarle also entered a non-binding agreement with Patriot to study the feasibility of a downstream lithium hydroxide plant integrated with the Corvette project. Additionally, Albemarle is building a facility at its Magnolia site in Arkansas to experiment with direct lithium extraction (DLE) technology. The company currently processes brines at Magnolia to produce specialty bromine chemicals. If successful, Albemarle would bolt this process onto the bromine operations to make lithium from the brine as well. While DLE technology is being developed worldwide with backing from almost every automaker and lithium major as a more energy-efficient way of processing lithium, no one has deployed the technology beyond the pilot scale. Regardless of its DLE success, these represent a significant expansion in Albemarle’s North American presence.

Ghana approves mining framework, Atlantic Lithium optimistic

Ghana’s Lands and Natural Resources Minister Samuel Jinapor announced last week that the cabinet had approved a green minerals policy framework to manage lithium production in the country. The policy will clarify the previous announcement that companies cannot export lithium as raw ore. Though not law yet, the regulatory framework is expected to pass through parliament later this year. While Ghana does not currently produce lithium, its reserves are among the largest in Africa, and Australian exploration company Atlantic Lithium is the closest to production in the country. Atlantic is in talks with Ghana’s Minerals Commission and is confident they will get a mining lease later this year with the new legal framework in place. The company expects to commission the Ewoyaa lithium project in Ghana in 2025, producing a spodumene concentrate from the ore it mines (in compliance with the export regulations). Atlantic has a strong backer in US-based Piedmont Lithium, which owns nearly 10% of the company and has rights to 50% of the offtake at the project. Piedmont recently received its first shipment of spodumene concentrate from North American Lithium, a project in Quebec that Piedmont backed alongside Sayona Mining. This offtake will supply batteries manufactured by LG Chem. Mining investment is challenging in regions like Africa that often lack legal clarity. Still, the legislation passing through the Ghanaian government is a step in the right direction on this front.

Saudi Arabia buys 10% of Vale base metals unit

A joint venture between Saudi Arabia’s Public Investment Fund and state mining company Ma’aden purchased a 10% stake in Vale’s base metals business, valuing the business unit at $26B. The Saudi coalition beat out Japanese trading house Mitsui & Co and the Qatar Investment Authority in the final round of bidding. While known for oil, Saudi Arabia is increasingly involved in the mining industry, announcing a joint exploration venture between Ma’aden and Robert Friedland’s Ivanhoe Electric in January. Additionally, Barrick Gold, which already operates the Jabal Sayid copper mine as a 50-50 JV with Ma’aden, has strengthened partnerships to explore more regions of the Kingdom. As investor focus shifts away from oil and towards minerals needed for the energy transition, Saudi Arabia is engaging in a parallel strategy of investing in critical minerals abroad while developing mining and processing capabilities domestically. For Vale, the investment provides cash to deploy at existing and exploration-stage copper and nickel projects as the company works to grow its base metals division to match its iron ore production (second largest in the world). Vale’s stock trades below many peers with large base metals production due to the significance of Vale’s iron ore assets in Brazil and the shadow of the tragic Brumadinho dam collapse in 2019. A spin-off IPO of the base metals unit could potentially unlock billions of dollars of latent value.

US DoE adds copper to critical minerals list

The US Department of Energy released the 2023 Critical Materials Assessment, a report summarizing materials significant to the US economy, focusing on minerals required for clean energy technologies facing supply chain gaps. The assessment includes a list of “critical minerals,” which the Energy Act of 2020 defines as a “non-fuel mineral or mineral material essential to the economic or national security of the US and which has a supply chain vulnerable to disruption.” This designation as a critical mineral informs tax incentives under the Inflation Reduction Act and higher visibility in DC and beyond. The finalized list1 for 2023 includes copper, uranium, electrical steel, and silicon carbide for the first time, of which copper is the most significant addition. The graphic below shows the latest designations of minerals deemed critical, mapped based on supply risk and importance to energy production.

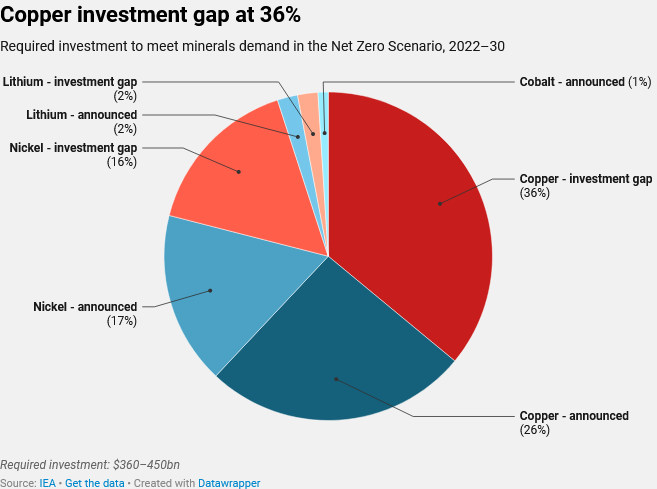

Of all the minerals required for the energy transition, copper has the most underinvestment to reach production levels needed for climate goals, with some estimates of more than $100B still required to be invested in copper mining and processing over the next decade, as the graphic below shows. Though copper is already mined in the US, critical mineral designation indicates that the DoE recognizes the sheer amount of capital that must flow into the commodity, so the DoE will do more to back these projects (as they have with lithium projects via the Loan Programs Office). The copper industry has been advocating for inclusion in the critical minerals list for years, and this past February, Senator Kyrsten Sinema wrote a letter alongside five Senate colleagues (from both parties) to US Interior Secretary Deb Haaland urging her to designate copper as a critical mineral.

Niger coup threatens EU uranium supply

Following a coup in Niger on the 26th of July, reports have come out that the country will halt exports of uranium to France. France, which derives nearly 70% of its electricity from nuclear power, buys around 16% of its uranium from Niger. The European Union is even more reliant on the country at 25% of EU uranium imports, making Niger its top supplier of uranium. France and the EU have several years of nuclear fuel reserves, with the European Commission saying they have “sufficient inventories of uranium to mitigate any short-term supply risks.” If the export ban does materialize, Europe will need to find new sources from which to import uranium. However, the World Nuclear Association estimates that global uranium production is not currently sufficient to meet demand by the international nuclear fission fleet, so finding an alternate source could be a problem and lead to higher uranium prices (illustrated in the graph below). However, the cost of uranium only accounts for around 6% of the cost2 of nuclear energy, so electricity prices are not likely to be affected. State-owned mining company Somair is responsible for uranium mining in Niger, while Somair is controlled (by a 63.4% stake) by French state-owned nuclear fuel producer Orano. Orano claims they will continue operating in Niger, but the political situation makes that claim look uncertain.

Russia’s involvement further complicates the mineral situation in the Sahel, with US Secretary of State Anthony Blinken stating that the private military contractor Wagner Group is taking advantage of the instability in Niger. Wagner currently operates in neighboring Mali, and the Russian cyber machine has spread anti-French and anti-American propaganda in surrounding countries. Though not appearing to be responsible for the coup, Russia has plenty to gain, notably more significant influence on Niger’s uranium endowment. Russia, Kazakhstan, and Uzbekistan account for 55% of uranium mining, while Russia alone contains 45% of uranium conversion and enrichment, the processes required to create fuel for nuclear power plants. The United States still imports approximately a third of the enriched uranium used by its utilities from Russian state-owned companies, paying them nearly $1B last year. While sanctions have severed ties between Russia and the West over the past two years, the US and Europe still rely on Russia for uranium (and several other metals, notably titanium used in the defense industry). A Niger-originated uranium supply shock could be a golden opportunity for the US and EU to take action to re-develop a domestic uranium mining, conversion, and enrichment supply chain to achieve energy independence using the cheapest and most-reliable carbon-free fuel. Otherwise, this supply could end up falling into Putin’s hands.

That’s all for this week. Thank you for reading, and if you have not yet, please consider subscribing.

- Teddy

aluminum, cobalt, copper, dysprosium, electrical steel (grain-oriented steel, non-grain-oriented steel, and amorphous steel), fluorine, gallium, iridium, lithium, magnesium, natural graphite, neodymium, nickel, platinum, praseodymium, terbium, silicon, and silicon carbide

Investment costs account for 59% while operation and maintenance comprise another 25%

Well written & informative - thank you!