This Week in Critical Minerals - #5

Partnerships in lithium and nickel, record cobalt prices, and a controversial battery plant

Welcome to the fifth issue of This Week in Critical Minerals, where I cover the mining and resource processing projects and technologies being built around the world.

Thank you for joining me. Let’s dig in.

Lithium

Tesla rumored to buy Sigma Lithium

A Friday Bloomberg report indicated that Tesla is rumored to be looking at acquiring Sigma Lithium. Sigma is currently developing the Grota do Cirilo Project in Brazil. Sigma Lithium aims for phase one to be in production in the first half of this year at a rate of 36,700 tonnes of per annum (tpa) of lithium carbonate equivalent (LCE). By the end of 2024, Sigma aims to completes phase 2 and phase 3 of the mine, bringing lithium carbonate production up to 104,200 tpa. This would make Sigma the fourth largest lithium producer in the world. The company has been exploring an acquisition, though talks are still in the early stages. Agreeing on a price may prove difficult, as shares of the company have tripled in the last 12 months (as well as a 24% after-hours surge on Friday). Supposedly Tesla has been in discussions with several lithium mining companies, but nothing is official as of now. Tesla has announced that they would open a lithium refinery in Texas, and this is a bigger part of that same strategy to vertically integrate. Tesla is starting to lag behind rival EV manufacturers like GM and Ford, who have both made investments in battery metal producers (GM with Lithium Americas for lithium and Ford with Vale for nickel).

LG Chem invests $75MM in Piedmont

LG Chem, Korean chemical and battery manufacturer, made an equity investment of $75MM in US lithium developer Piedmont Lithium. As part of the terms of the deal, LG Chem will get access to 50,000 tonnes of spodumene concentrate for four years, beginning in Q3 2023 from North American Lithium (NAL). NAL is a project in Quebec developed by Sayona Mining (through subsidiary Sayona Quebec) beginning production in the next month. Piedmont owns 25% of North American Lithium, and has the right to purchase 50% of the spodumene concentrate produced by the project, a significant portion of which will now go to LG Chem. Piedmont will use the capital to develop its Tennessee and North Carolina lithium hydroxide production facilities.

Ghana mining fund in talks to invest $30MM in Atlantic Lithium

State-owned Minerals Income Investment Fund (MIIF) is reportedly in talks with lithium developer Atlantic Lithium to invest up to $30MM in the company. Atlantic has also agreed to list on the Ghana Stock Exchange. The MIIF manages royalties from mines (primarily gold) across Ghana, and this would be their first investment in lithium. Atlantic recently updated their mineral resource estimate, bringing the life-of-mine revenue to nearly $5B. Auto manufacturing is on the rise, with Toyota, VW, and Nissan opening manufacturing plants in the country. The government is hopeful more of the EV supply chain will move into the country, with Atlantic Lithium representing a significant step towards that.

Copper

Mitsubishi Materials aims to triple copper output by 2030

Japanese conglomerate Mitsubishi aims to increase production of copper concentrate from 150,000 tpa to 500,000 tpa by 2031. The company plans on increasing throughput at their Naoshima and Onahama smelters/refineries and potentially some mining acquisitions “targeting projects that have considerably progressed in terms of the development stage, and those that are in the early stage,” according to Mitsubishi Materials president Naoki Ono. Mitsubishi already owns stakes in copper mines in Chile such as Los Pelambres and Mantoverde. They are also considering investments in rare earths and lithium ion battery recycling. Mitsubishi continues to increase its exposure to energy transition metals, to the benefit of their materials and automotive businesses.

Nickel

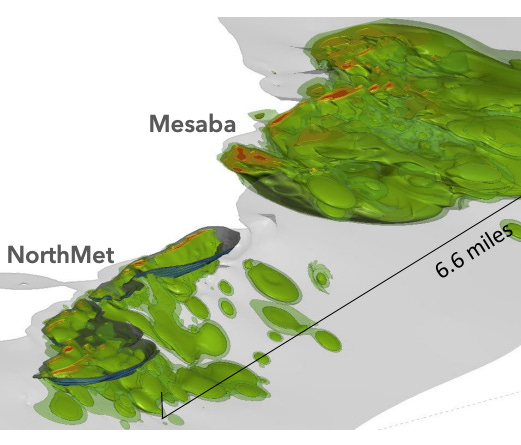

Teck-PolyMet joint venture aims to open 2nd nickel mine in US

Canadian mining firm Teck and American PolyMet have formed the NewRange Copper Nickel joint venture. PolyMet owned several assets in the Duluth region of Minnesota, and was developing the NorthMet ore body. Teck also holds the Mesaba project in the region, but that area has not been explored as much as PolyMet’s assets. These assets are now owned by the joint venture. The region is also home to Talon Metals’s nickel project, which is in early stages of permitting, as well as Twin Metals’s mine, which was blocked by the Department of Interior just a few weeks ago. Unlike Twin Metals, the New Range project’s minerals rights leases are from the state, not the federal government, so the company does not foresee the same issues as Twin Metals. Glencore is a major shareholder of PolyMet with 71% of the company, while China Investment Corp (China’s sovereign wealth fund) is the largest shareholder of Teck, at 10% ownership. The larger combined entity will be better capitalized to increase exploration activity, receive permits and fight lawsuits, and eventually build these critical nickel-copper projects in the United States.

Cobalt

Price collapses to near historic lows

The price of cobalt has fallen more than 50% over the last year, following a demand decrease and increased supply coming onto the market. Consumer electronics batteries is a significant market for cobalt. Demand peaked for these products during the pandemic and has since fallen. Additionally, cobalt is used in lithium ion batteries for EVs, but over the last decade the amount of cobalt used in those batteries has decreased in proportion to other metals like nickel. The Democratic Republic of the Congo is seeing a significant ramp-up of cobalt mining in the country, as Glencore and China Molybdenum continue to increase investment in the country. Further, as nickel production ramps up in Indonesia (for EV batteries), cobalt is produced as a byproduct, increasing the blue metal’s availability. As nickel projects continue to come online, and with expected rise of battery recycling, it is unlikely that cobalt prices will approach anywhere near their early 2022 peak for the foreseeable future.

Batteries

Ford, CATL to build Michigan battery plant

Ford, through a wholly-owned subsidiary, is setting up a $3.5B lithium iron phosphate (LFP) battery plant in southwest Michigan, licensing battery technology and technical expertise from Chinese battery giant CATL. Though Ford would wholly own the facility, there are still questions being asked about the deal’s national security implications. Senator Marco Rubio, top Republican on the Senate Intelligence Committee, has asked the Biden administration to review the deal, arguing that Inflation Reduction Act tax credits would benefit CATL and the Chinese government. Beijing has also expressed concern about LFP battery technology (which the US is behind in) being handed over to an American automaker. The site in Michigan was chosen after Virginia governor Glenn Youngkin’s decision to withdraw the state from the competition to attract the plant just one month ago. Ford has also collaborated (through joint ventures) with South Korean LG Energy Solution and SK to produce batteries. The partnership with CATL enables Ford to produce batteries at a lower cost, but would rely on on the US’s geopolitical adversary.

Key Takeaways

Automakers and battery manufacturers are putting real capital into mining companies to secure supplies of critical minerals - e.g. Tesla and Sigma Lithium, LG Chem and Piedmont Lithium, and Ford and CATL.

The Teck-PolyMet joint venture aims to create a better capitalized entity to open the second nickel mine in the US.

The cobalt price is at a record low and is unlikely to rise as demand stays flat and supply increases.

That’s all for this week. Thank you for reading, and if you have not yet, please consider subscribing.

- Teddy