This Week in Critical Minerals - #2

Lithium price targets rise, trouble with copper production, deep-sea discoveries, and more

Welcome to the second issue of This Week in Critical Minerals, where I cover the mining and resource processing projects and technologies being built around the world.

Thank you for joining me! Let’s dig into it.

Lithium

Albemarle increases estimated production, price targets

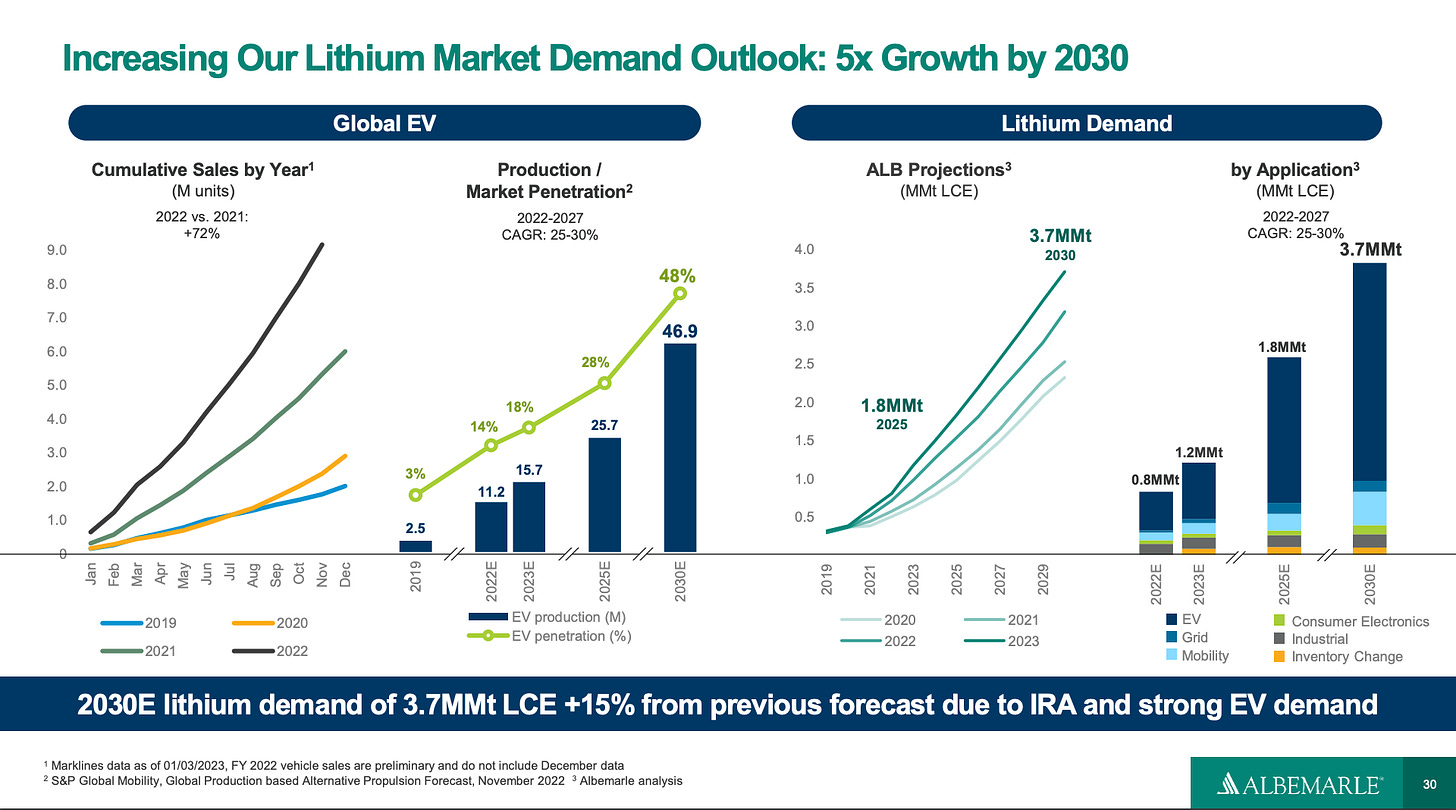

Albemarle, the largest lithium company in the world (by market cap and production), gave its 2023 strategic update this week in which they raised their lithium demand outlook for 2030 to 3.7 MMT (million metric tonnes), almost double their 2030 projections from just three years ago. This represents a predicted 5X in demand from 2022 lithium production in just 8 years. Simply put, this supply gap is not going to close in that timeframe, even with capital pouring in from auto manufacturers and governments. Lithium projects take approximately 10 years to reach production, in many cases longer. Additionally, Albemarle expects their cost of lithium production to more than double over the next decade, squeezing profit margins from 65% in 2022 to approximately 45%, even accounting for elevated lithium prices. With a shortage of supply and projects requiring more capital to develop, it is likely that lithium prices remain high for an extended period of time, raising costs of lithium-ion batteries and electric vehicles for consumers. Albemarle currently operates lithium mines in Nevada, Chile, and Australia, and has conversion facilities in Nevada, Tennessee, North Carolina, Germany, Chile, China, Taiwan, and Australia. Their Silver Peak mine in Nevada is currently the only operating lithium mine in the United States.

State-run lithium exploration to begin soon in Mexico

This past week Mexican President Andres Manuel Lopez Obrador (AMLO) said that his government is working to reach an agreement with a company currently exploring for lithium in the northern state of Sonora. Many are speculating that this firm is Chinese lithium producer Ganfeng, though this has not yet been confirmed. AMLO has stressed that lithium belongs to the nation, so he will be giving a state-run firm exclusive access to lithium exploration permits beginning next month. This is a different approach to other Latin American countries like Argentina and Chile, where lithium projects have been developed by or in collaboration with foreign companies (mostly Chinese or American).

Nickel

Stillwater estimates 1 billion pounds of nickel at Montana project

Canadian exploration company Stillwater Critical Minerals increased its minerals resource estimates at its Stillwater West Project in Montana by 62%. The new estimate includes 1.05 billion pounds of nickel, 499 millions pounds of copper, 91 million pounds of cobalt, and 2.05 million ounces of palladium. The company is continuing exploration work as they work towards a feasibility study and mine plan. The project is located in a historic mining district (Stillwater igneous complex) in western Montana, with mining giants Rio Tinto and Ivanhoe Electric making significant investments in other projects in the area in recent years. With positive resource estimates so far, Stillwater’s project could turn into a significant source of critical minerals for the United States.

Copper

Production threatened in South America

Protests across Peru are affecting copper output in the number two global producer of the metal. Protests have been raging for six weeks after the impeachment of former President Pedro Castillo, with protestors demanding the removal of current President (former VP) Dina Boluarte. Glencore has halted operations at its Antapaccay copper mine after protesters attacked a worker camp and set fire to a water plant supplying the mine and thousands of local residents. MMG’s Las Bambas mining complex is operating at just 20% capacity due a blockade of key highways in the region. Several mines in the north of Peru, including BHP Group-Glencore’s Antamina mine, are able to function normally, as they do not rely on the blockaded roads for supplies and transport.

Staying in South America, a government report out of Chile, the largest producer of copper with 27% of global output, showed that copper production is expected to peak in 2030. This is two years later than expected largely due to delays in mine construction and expansion. Additionally, Chile’s peak copper output is forecast to be lower than prior predictions. Major US-based copper producer Freeport-McMoRan said that expansions of its copper projects in Chile were on hold due to political instability in the country.

Companies producing in South America, particularly Peru and Chile, are wary of the political situation, and if closures and delays continue, copper prices could be impacted.

Freeport-McMoRan producing less in US from labor shortage

Freeport-McMoRan, operator of seven mines in the United States, reported in its Q4 earnings call last week that copper production had fallen 7% compared to Q4 2021, and is expected to fall an additional 1% in the next year. The company sees the source of these problems as a chronic labor shortage across the mining sector and is planning on substantial pay raises over the next year to remedy the issue. CEO Richard Adkerson said on the call that “it’s harder to drive a big haul truck than it is to drive an Amazon or UPS or FedEx truck.” Freeport reported net income down 36% year-over-year at around $700MM, with copper prices down to $3.77/lb from $4.42/lb over the same period. This labor shortage, particularly in the US, comes at a time when demand for metals like copper is drastically increasing. With companies like Freeport not producing at maximum capacity, we could see serious shortages of copper in the next decade.

US Department of Interior blocks mining in NE Minnesota

The US Department of the Interior closed 350 square miles of Superior National Forest to mining projects for the next 20 years, in an effort to protect the Boundary Waters Canoe Area Wilderness. This ruling may be the death knell for Twin Metals, a copper and nickel project in this part of Minnesota owned by major Chilean copper producer Antofagasta. The Trump administration had given the company federal mineral rights, which the Biden administration revoked last January. Twin Metals claims it can build the mine without generating acid mine drainage, a polluting process in which water and air flow over sulfide-bearing ores and react, causing acidic water to be released to the environment. The Biden administration considers this still to be an unacceptable risk to the popular tourist destination and nature preserve. Other mining projects, including the Talon Metals nickel mine near Tamarack, MN, remain unaffected by the order, as they are located in different watersheds. This project demonstrates the tradeoffs and conflict between risk of environmental damage and necessity of battery metals like copper and nickel, both of which are stated priorities of the current administration.

Massive copper and zinc deposits found on Norwegian seabed

Norwegian authorities announced on Friday the discovery of massive quantities of critical minerals on the sea floor of the Norwegian Sea and Greenland Sea. The estimated resources include 38 million tonnes of copper, almost double 2021 global production of 22 million tonnes, and 45 million tonnes of zinc. These metals were primarily found in polymetallic sulfides, deposits of sulfur and metals formed under heat and pressure near hydrothermal vents around 3000 meters below the surface. Vast quantities of magnesium, niobium, cobalt, and rare earths were also discovered. Though large in quantity, this discovery is not yet of any significance to solving problems of supply shortages of these metals, as a regulatory pathway to undersea mining is still unclear on both a national and international level. Little is known about marine ecosystems at these depths, so any sort of mining activity here faces steep resistance from environmental groups. Further studies are being done looking into the feasibility of deep-sea mining in Norway.

Rare Earths

Phoenix Tailings completes first rare earth metals refinery in the US

Massachusetts-based startup Phoenix Tailings announced that they have built the first rare earth metals refinery in the United States, successfully completing a pilot scale project while constructing a commercial-scale facility to eventually produce 120 tons of rare earth metals per year. The company’s technology extracts rare earths (currently neodymium and dysprosium) from tailings (mine waste) without toxic byproducts or carbon emissions. Neodymium is a key component of the permanent magnets used in electric motors and dysprosium is used in control rods for nuclear reactors. The US is currently lacking rare earths processing capabilities, though companies like MP Materials and Lynas Rare Earths are building in the space. Phoenix Tailings’s technology has the potential to significantly increase the quantity of rare earths processed in the United States, and do so in an environmentally sound way.

Batteries

Tesla to expand Gigafactory Nevada

Tesla has invested $6.2B to build the 5.4 million square foot Gigafactory Nevada over the last nine years and on Tuesday committed another $3.6B to expand the facility. The expansion will include two new projects: a 100 GWh 4680 battery cell factory (enough capacity to supply an additional 1.5 million EVs per year) and the first high-volume Semi truck factory. The expansion would bring Tesla’s battery capacity to 439 GWh in 2030, second only to Chinese automaker BYD, at 546 GWh of expected capacity, according the Benchmark Mineral Intelligence. The expansion shows a desire by Tesla to drive down costs in its battery cells by ramping production at the same time as it moves to own more of the battery supply chain, including building a lithium refinery in Texas.

Key Themes

Albemarle expects lithium prices to remain high as projects come online slower than demand

Copper production is stalling in Peru and Chile due to political instability, and in the US due to labor shortages

Conflict within the Biden administration over risk of environmental damage and need for critical minerals — not looking great for the miners (for at least the next two years)

Discoveries of vast resources underwater continue to be made, yet remain inaccessible under current regulatory frameworks

Tesla continues to expand battery production while focusing on vertical integration

That’s all for this week. Thank you for reading, and if you have not yet, please consider subscribing.

- Teddy