This Week in Critical Minerals – #17

Copper, lithium, nickel, and uranium news

Copper

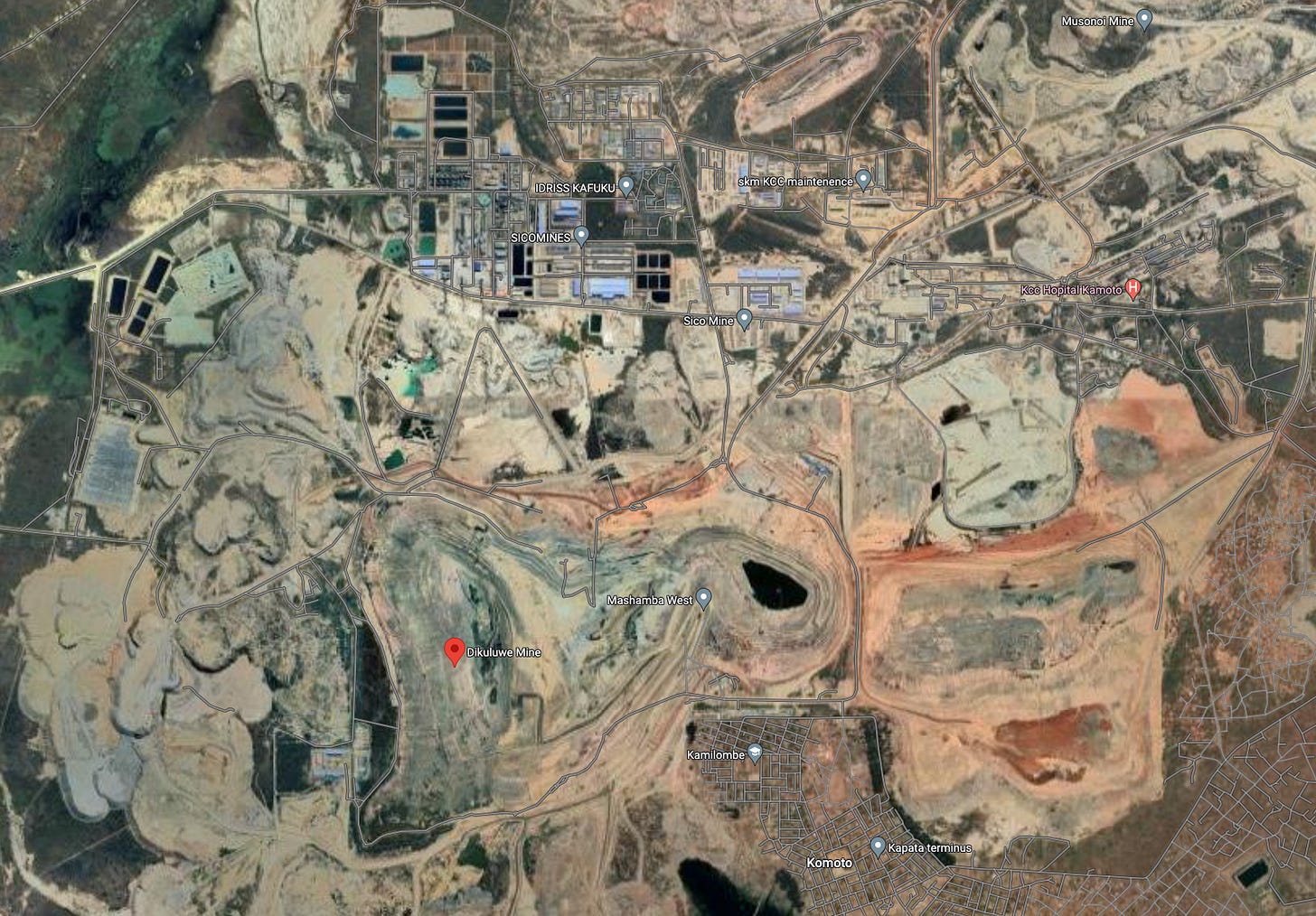

Chinese to invest $7B in DRC. In 2008, the governments of China and the Democratic Republic of the Congo signed a landmark “minerals-for-infrastructure” deal in which Chinese companies got 68% of a joint venture company called Sicomines, mining copper and cobalt in the southern DRC. In exchange, the Chinese companies would need to spend $3B on infrastructure around the country. The Chinese consortium includes major companies such as China Railway Group Ltd, Power Construction Corp of China (PowerChina), and Zhejiang Huayou Cobalt Co. In the last 15 years, the Chinese consortium has spent only $822M of the promised $3B infrastructure investment, and many in the DRC were unhappy with the arrangement, with the state auditor Inspection Generale des Finances last year recommending the consortium’s infrastructure be increased to $20B to better reflect the value of the assets they received. There was also talk of increasing the Gécamines’ (DRC government’s) stake in Sicomines. Last week, a resolution to the dispute was announced, with the ownership in Sicomines remaining the same and the infrastructure commitments increasing to $7B. The DRC government will also earn a 1.2% royalty from the Sicomines project. There is still concern over the new agreement, as the negotiation process was entirely behind closed doors. No outside information about the Sicomines project (Dikuluwe and Mashamba deposits) is available, so it is difficult to independently assess the mine’s worth to determine if this is a fair deal. Just from aerial observations, the mine is several times the footprint of nearby operations like Mutanda (100% owned by Glencore) and Tenke-Fungurume (80% owned by CMOC), each of which produce billions of dollars per year of copper and cobalt. Additionally, some speculate that the Chinese infrastructure investment could come in the form of loans bearing interest, which could ultimately hurt the DRC (as similar loans have elsewhere in Africa).

Lithium

Sigma Lithium increases resource 27%. Sigma Lithium operates the Grota do Cirilo mine in Brazil, which commenced production last April. The company continues to expand the resource estimate for the project, which, after last week’s announcement, now stands at 109 Mt grading 1.4% Li2O. 94.3 Mt of this is in the measured and indicated category (very high confidence). Sigma plans on drilling 57 spodumene pegmatite targets outside the core Grota do Cirilo area, potentially increasing the resource to 150 Mt later this year. Sigma posted an adjusted EBITDA margin of 56% (net profit of 37%) in Q3 last year (its first full quarter of operation), bringing in $54.6M of adjusted EBITDA. However, lithium prices have fallen 50% in the last 6 months, so the profitability of Grota do Cirilo is now unclear. Accordingly, Sigma’s share price is down more than 60% from its high last May. Q4 results should be released sometime in the next couple of weeks. At the same time, the company has lost several top executives in the last six months, including the Chief Controls Officer (who resigned 2 weeks ago), Chief Operating Officer (who resigned in September), and co-CEO Calvyn Gardner, the soon-to-be-divorced husband of Sigma’s current CEO who was fired last year for trading during a blackout period.

MinRes to sell Azure stake, Mt Marion production jumps 30%. MinRes reported quarterly earnings last week, which included news that Mt Marion spodumene concentrate production is up 30% from last quarter. MinRes also received a $383M payment from Albemarle due to a restructuring of the MARBL joint venture, where Albemarle is taking over MinRes’s stake in the Kemerton lithium hydroxide processing facility. Additionally, MinRes CFO Mark Wilson confirmed that the company is planning to sell its stake in Azure Minerals. MinRes was left as a third wheel when SQM and Hancock offered to acquire the company in December. Wilson’s comments indicate that MinRes now believes it is better off selling its stake to the combined entity than staying on as a minority partner without any control.

Controlled Thermal Resources seeks $1B for Salton Sea project. Last week, Bloomberg reported that Australian startup Controlled Thermal Resources (CTR) is raising $1B of debt and equity to support the development of its direct lithium recovery and geothermal power plant at the Salton Sea in California. Stellantis invested more than $100M in the company last August and has a supply agreement for 65,000 mt of lithium hydroxide over 10 years. General Motors also invested in the company in 2021. CTR anticipates the production of 50 MW of power in late 2024 and the delivery of 25,000 mt of LiOH monohydrate in 2025 (pushed back from an initial target of 2024).

Ghanaian government acquires 3% of Atlantic Lithium. The Minerals Income Investment Fund of Ghana (MIIF) recently completed a subscription to purchase nearly 20M shares of Atlantic Lithium, representing $5M or 3% of the company. This is the first part of a larger investment by MIIF in the company, with MIIF set to invest an additional $27.9M for another 6% of Atlantic’s Ghana portfolio in the next few months. Atlantic Lithium’s share of the capex to develop the Ewoyaa lithium mine is $185M; investments by the Ghanaian government reduce their portion of the capex burden. Piedmont Lithium, a 50% offtake partner with Atlantic, is responsible for another $70M of capex. Though Piedmont once controlled nearly a quarter of the company, a few weeks ago, Piedmont sold ~40% of their remaining stake to Assore, the South African mining company that now owns 28.4% of Atlantic. Assore bid last November to acquire all of Atlantic at a ~60% premium to their share price (similar price today), but the offer was rejected. Atlantic is targeting its first production at Ewoyaa mid-next year.

Nickel

NiCAN releases positive drill results, shares soar. NiCAN is exploring the Wine property in Manitoba, an area adjacent to several historically producing nickel and copper mines (Lynn Lake, Thompson, Namew Lake). Last week, NiCAN released drill results from the Wine property, with highlights including 31.5 m of 1.93% Ni and 1.9% Cu, just 36.5 m below the surface (with smaller yet notable proportions of Co and PGMs). Over the same set of holes, there was mineralization even nearer to the surface as well, with 9.6 m of 1.56% Ni and 2.2% Cu starting at 4.2 m below the surface. This tiny company, now with a C$11M market cap, was one of the biggest movers on the TSXV last week, up 270% on Wednesday.

IGO puts Cosmos mine on C&M. Australian miner IGO operates the Nova (nickel-copper-cobalt), the Forrestania (nickel), and the Cosmos (nickel) mines, as well as owns a stake in a lithium joint venture with Tianqi. In mid-2023, the company commenced a review of the Cosmos project, and the results of that review indicated that the mine life is shorter, ramp-up more delayed, and capital/operating costs higher than expected, while nickel prices have collapsed at the same time. As a result, the company is transitioning the mine to care and maintenance by 31 May 2024. IGO acquired Cosmos and Forrestania just 19 months ago for A$1.3B and is significantly writing down the value of Forrestania as well. In their quarterly report, also out last week, it was shown that the company’s cash position is down 38% QoQ to A$276M. Just in the last quarter, IGO spent A$107M on construction at Cosmos, which calls into question the review process and planning of the company. Finally, lithium production at Greenbushes (which IGO owns 25% of through its JV with Tianqi) is down 14%, while the cash cost is up 36%. Not a great quarter for IGO.

Uranium

McClean Lake to resume production. Denison Mines (22.5%) and joint venture partner Orano (77.5%) recently announced the restart of the McClean Lake mine, located in the Athabasca Basin, as a reaction to increased uranium prices. Mining is expected to commence next year, with production in 2025 hitting 800,000 lb. McClean Lake uses a patented mining technique known as Surface Access Borehole Resource Extraction (SABRE), in which a high-pressure water jet is inserted at the bottom of a borehole to excavate a portion of the ore. The cuttings are then airlifted to the surface, resulting in a high-grade (4-11%) ore extracted at a lower cost than many competitor operations. Mining was last suspended at McClean Lake in 2008, and SABRE tests were conducted in 2021 to investigate the feasibility of the new mining method developed since the mine shut down.