This Week in Critical Minerals – #14

Copper, cobalt, and rare earths news

Copper

Jiangxi in talks with First Quantum over stakes in Zambian mines. First Quantum Minerals (FQM), the Canadian gold and copper producer who has been in the news of late over their Cobre Panama project, is reportedly in discussions with Chinese copper producer Jiangxi over the sale of its (FQM’s) Zambian copper assets. First Quantum operates two mines in northern Zambia, Kansanshi and Sentinel, producing 159,000 and 241,000 tonnes of copper (respectively) in 2022, as well as 101,000 oz of gold at Kansanshi. As First Quantum has substantial debt payments due in the next few years, as well as a tumultuous situation to deal with in Panama, the company is in need of cash. Though the nature of the potential deal with Jiangxi is unclear, it could result in the partial sale of both Zambian assets or the full divestiture of one of the mines. Bloomberg also reported that First Quantum has talked to Barrick in the last few months over a potential acquisition of the company. Mark Bristow, CEO of Barrick, has for years talked about Barrick’s desire to increase its copper production, as copper producers receive greater investor interest due to the metal’s criticality and significance to the energy transition, i.e., Barrick would trade at a higher multiple with more copper production. A First Quantum acquisition would provide that boost. Barrick also operates the Lumwana copper mine in Zambia, located between First Quantum’s Kansanshi and Sentinel mines, so synergies in the country would be an attractive part of the acquisition. Additionally, Barrick has experience developing mines and negotiating with governments in unstable jurisdictions, for example, the Porgera gold mine in Papua New Guinea and the North Mara gold mine in Tanzania. Regardless of the outcome, without revenues from Cobre Panama, First Quantum is going to need to find a way to generate cash.

Teck forms joint ventures in South America. Following the acquisition of 77% of its coal subsidiary Elk Valley Resources by Glencore last year, Teck announced last week the sale of its remaining stake in the coal business, with Nippon Steel acquiring 20% and POSCO increasing its ownership to 3%. Now fully divested from coal, Canada’s Teck Resources has renewed its focus on copper, as demonstrated by two joint ventures this past week with exploration companies in South America. AbraSilver Resources is exploring the La Coipita copper-gold project in Argentina. Teck’s agreement with AbraSilver grants Teck the option to acquire an 80% interest in La Coipita by funding $20M of exploration activities over 5 years, a total of $3M of cash payments and an equity placement, and $6.3M in cash payments to project vendors. Condor Resources is exploring the Cobreorco copper-gold project in Peru. Condor’s agreement with Teck gives them the right to earn a 55% interest in the Cobreorco project by funding $4M in exploration expenditures and making $500K of cash payments. Teck can earn another 20% (75% total) by committing an additional $6M in exploration expenses and $600,000 of cash payments. Teck has a history of mining in South America, with major stakes in the Antamina mine in Peru, as well as the Quebrada Blanca and Carmen de Andacollo mines in Chile.

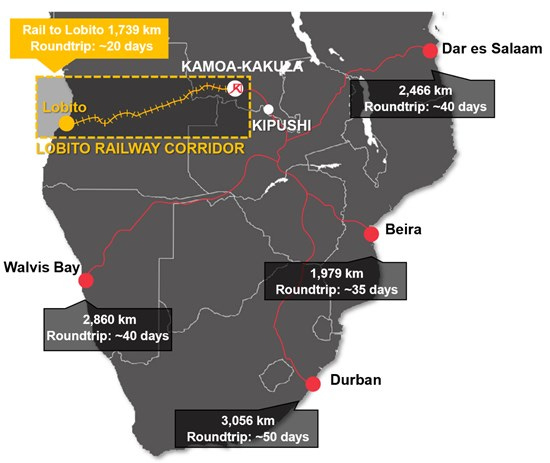

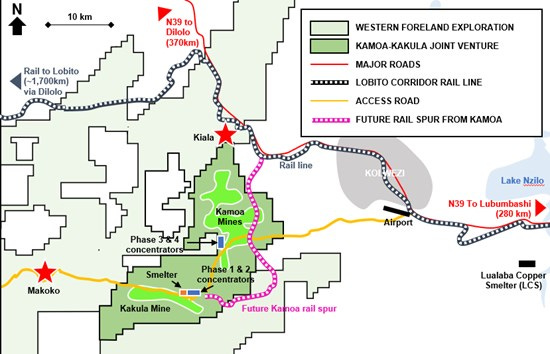

Ivanhoe’s first shipments through Lobito Corridor complete transit. The Lobito Atlantic Rail Corridor is a major new transportation route connecting the city of Kolwezi, located near many significant copper and cobalt mines in the Democratic Republic of the Congo, to the Atlantic port of Lobito in Angola. The rail project was developed with the backing of the US and EU (in part to counter China’s Belt and Road Initiative), as well as support from major mining and commodities companies like Ivanhoe and Trafigura. Ivanhoe Mines’s first shipment of copper concentrate (1100 tonnes) arrived at Lobito 8 days after it was set off from Kolwezi, just 5 miles from the Kamoa-Kakula Copper Complex. The route to export copper from Kamoa-Kakula was previously a 20 to 25-day trip by truck to various ports around Sub-Saharan Africa. Ivanhoe plans to build a rail spur directly to the Kamoa-Kakula mine, eliminating the need to ship copper concentrate by truck any distance. Additionally, the Lobito Corridor rail line runs directly through the Ivanhoe-owned Western Forelands exploration project, a promising area of discovery for an additional copper mine.

Cobalt

CMOC is now the world’s largest cobalt producer. CMOC (China Molybdenum Company) released 2023 production data last week, reporting cobalt production of 55,526 tonnes, a massive increase of 174% compared to last year. Most of this increase is attributable to the Kisanfu mine, which was commissioned in Q2 of 2023. Kisanfu is majority-owned by CMOC (71.25%), with battery maker CATL (23.75%) and the DRC government (5%) comprising the remainder. CMOC invested $1.8B in phase one construction at the mine following its purchase in 2020. The rest of the increased cobalt output is attributable to CMOC’s other DRC asset, Tenke-Fungurume. The massive increase in cobalt supply by CMOC, as well as supply associated with nickel mining in Indonesia, has caused the cobalt price to fall substantially over the last year. With Glencore guidance suggesting an output of 38,000 tonnes of cobalt in 2023, CMOC produced the most of the battery metal last year.

Rare Earths

Energy Fuels has the option to develop the Donald rare earth project with Astron. Energy Fuels recently signed a nonbinding MoU with Astron over the joint development of the Donald rare earths and minerals sands project in Victoria, Australia. Mineral sands are a type of mineral deposit often found near the surface, containing heavy minerals of economic value such as zircon, ilmenite, rutile, leucoxene, and monazite. These minerals have historically been important sources of zirconium and titanium, but now the focus of these projects is the rare earth elements contained in the monazite. Though it is relatively simple to extract valuable minerals due to the ability to separate the heavy mineral sands (containing the desired minerals) from the rest by density, these mineral sands often contain trace amounts of thorium and uranium, so the concentrates produced require processing to remove the radioactivity. The agreement gives Energy Fuels the right to invest A$180M in the project and issue $17.5M of shares to Astron in exchange for 49% of the venture and 100% of the rare earth concentrate offtake. Energy Fuels will process this concentrate at its White Mesa Mill in Utah, which is the only facility of its kind in the US able to remove radioactivity from these rare earths and convert them to rare earth oxides (MP Material’s facility does not need to remove radiation). The company has other sources of rare earth concentrate from minerals sands, including an offtake agreement with Chemours (from their production in southeast Georgia) and Energy Fuels’s wholly-owned Bahia Project in Brazil.