This Week in Critical Minerals - #10

Copper/gold M&A, export bans, LME court case, and more

Welcome to the tenth issue of This Week in Critical Minerals, where I cover the mining and resource processing projects and technologies being built around the world. Let’s dig in.

Barrick Gold looking to get into copper

News came out last week that Barrick Gold recently approached First Quantum Minerals with an informal takeover offer at the market value of $17B, which First Quantum rejected. Barrick is the second-largest gold producer in the world, but its gold production is at the lowest level since 2000. CEO Mark Bristow has been public about wanting to get the company involved in copper mining in recent years, saying that copper is critical for mining companies to stay relevant today. Already acting on this, Barrick is investing nearly $7B in the Reko Diq copper-gold project in Pakistan which is slated to achieve first production in 2028. First Quantum on the other hand is primarily a copper company with significant assets in Panama and Zambia. The company recently resolved a dispute with the Panamanian government over royalty payments from its massive Cobre Panama mine. Shares of First Quantum jumped nearly 10% on the announcement, while Barrick dropped 2%. The world’s largest mining companies are all looking to increase exposure to copper, with BHP taking over OZ Minerals at the end of last year, Rio Tinto buying out the remainder of Turquoise Hill, and Glencore’s current bid for Teck Resources. With increased institutional and retail interest in energy transition metals like copper, copper companies have outperformed the overall mining industry in the public markets. Barrick is looking to get a piece of this action.

Codelco CEO steps down

The CEO of Chilean state-owned copper giant Codelco, André Sougarret, is stepping down from the job just one year after his appointment. Sougarret previously managed El Teniente, the world’s largest underground copper mine, and became well-known in 2010 as the leader of the rescue of the 33 miners trapped in the San José mine following a collapse. He later left the company for Antofagasta, followed by stints at Chilean state-owned ENAMI and Minera Fresnillo. Codelco is facing a number of problems, including production falling 11% in the past year to a 25-year low, despite investing billions of dollars to expand their aging mines. Additionally, the government has tapped Codelco to negotiate stakes in Albemarle and SQM’s lithium assets in Chile, as the government seeks to capture more value from the emerging lithium industry. While demand and production of lithium are growing substantially, extracting lithium from salars (brine ponds) is a vastly different process from copper mining, so Codelco does not have much expertise in this new venture. These two reasons are speculated to have contributed to Sougarret’s departure.

Mineral Resources lowers guidance on WA lithium assets

Iron ore and lithium miner Mineral Resources (MinRes) put out an announcement on Friday afternoon with some updates on their lithium operations. MinRes currently operates the Wodgina mine in the Pilbara in Western Australia as a 60-40 (MinRes minority) joint venture with Albemarle. The announcement reported that Wodgina production would be at the low end of guidance at around 150k dry metric tonnes (dmt) of SC6 (spodumene concentrate) equivalent. Additionally, they revised cost of production estimates at Wodgina upwards from A$850-900 to A$925-975 per tonne of SC6. MinRes also operates the Mt. Marion mine near Kalgoorlie in Western Australia as a 50-50 JV with Chinese lithium mining and processing company Ganfeng. MinRes had an agreement to sell its 50% of the spodumene (lithium-bearing mineral) concentrate produced at Mt. Marion to Ganfeng at a price based on the market price for lithium chemicals (LiOH, LiCO3) which was terminated on June 1. MinRes will now sell its offtake at the market price for spodumene concentrate. MinRes Managing Director Chris Ellison remarked in the update that “The early termination of the Mt Marion toll treatment agreement with Ganfeng is a sensible outcome given prevailing market prices, with our world-class lithium assets well-placed to capitalise on growing demand.” He seems to be alluding to the fact that prices for lithium chemicals have fallen much more than spodumene from their peak (though both have since bounced back slightly from their low a couple of months ago), so basing the price on spodumene will now result in a better price for MinRes. Finally, MinRes revised production guidance for Mt. Marion down from 160-180k dmt to 145-150k dmt of SC6. While the revised guidance and new pricing structure will have a material impact on the business, MinRes’s underlying EBITDA in the half year ending 31 December 2022 was A$939M with nearly 40% margins.

Namibia bans export of unprocessed critical minerals

On Monday, May 29, Namibian Mines and Energy Minister Tom Alweendo made comments implying that the government may take stakes in mining projects in the country. The following week, the news was clarified that this would only apply to future projects in the country, not existing operations. Last week, Minister Alweendo announced that the state would ban the export of unprocessed critical minerals, notably lithium. Namibia is a major exporter of diamonds and uranium, and more recently major discoveries of lithium have been found in the country. This announcement preempts the development of most of the lithium resources in the country. There are more than half a dozen junior mining companies with lithium exploration projects, and one currently producing mine owned by Andrada Mining, who produces a concentrate on-site so would most likely be exempt from the recent ban. Chinese companies are also involved in the country, notably, Xinfeng Investments, whose license to mine lithium was canceled a few months ago following local opposition to their planned mine and processing plant and controversy around their acquisition of the license in the first place (i.e. corruption). Namibia is not the only country to enact laws like this, with Zimbabwe and Indonesia being some of the notable examples. While Indonesia saw a tenfold increase in nickel production following its ban, Zimbabwe’s local miners have been forced to stockpile their ore while giant Chinese corporations with the capex to support local processing plants are able to export their product. These sorts of bans are gaining steam around the developing world, but so far have seen mixed results.

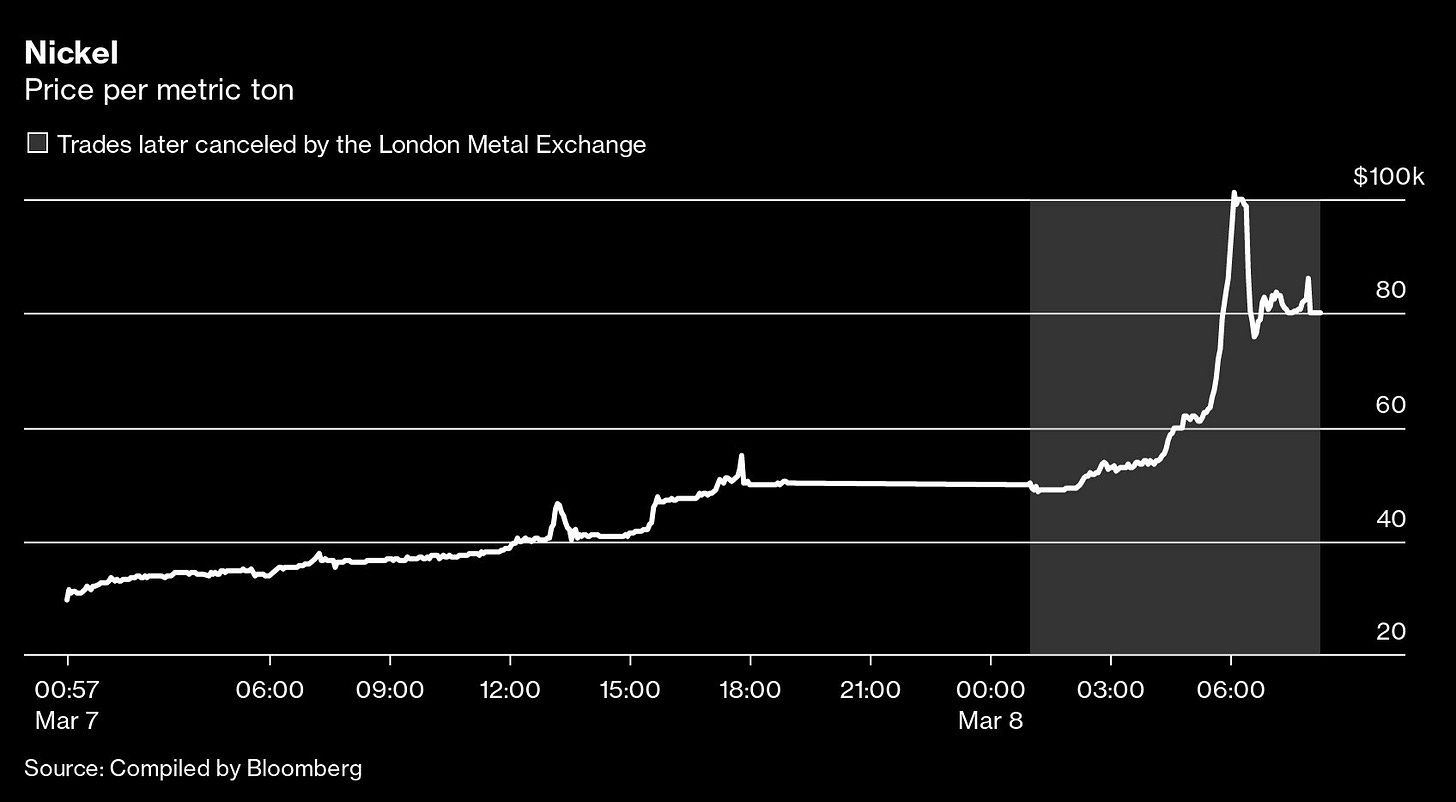

Paul Singer to battle LME over nickel trading halt

On March 8, 2022, nickel prices skyrocketed and the London Metal Exchange halted trading, going so far as to roll back trades from earlier in the day. The LME’s actions have been widely condemned and is facing a probe by the UK’s Financial Conduct Authority. Traders from all over the world were caught up in the mess, notably Paul Singer’s hedge fund Elliott Investment Management. While the hedge fund has not disclosed details of its nickel position, a portfolio manager at the firm and legal filings indicated that it had built up a substantial position in nickel call options. As nickel prices more than doubled on the morning of March 8, Elliott was selling its position, but those trades were later reversed, and the firm ended up with far less of a gain than it would have if the market had operated without interference. Lawyers on behalf of Elliott are heading to the High Court in London to argue their case against the LME in a three-day hearing that starts Tuesday. Elliott is pursuing a judicial review of the LME, a “court proceeding in which a judge reviews the lawfulness of a decision or action made by a public body.” The last time a judicial review was won against the LME was in 2014 over a change in warehousing rules, but that was later overturned. Singer gained notoriety for his investments in sovereign distressed debt, notably in Argentina, which defaulted on its debt in 2002. Singer fought for repayment in the courts for more than a decade, going so far as to attempt to seize an Argentine naval vessel in Ghana in 2012 and rights to two SpaceX satellite-launch contracts in 2014, before finally reaching a settlement in 2016. If history is any indication, the fight with the LME could be protracted and remain unresolved for quite some time.

Teck engaging multiple parties on coal assets

On April 3rd, mining giant Glencore proposed a merger between itself and Teck Resources, the leading Canadian diversified mining company. The plan would retain Teck’s base metals assets (notably its copper mines in Canada, Chile, and Argentina) while spinning off the merged company’s coal assets into a separate entity. The proposal has been rejected by Teck, but Glencore is expected to present a revised offer in the next few weeks. Prior to Glencore’s proposal, Teck announced plans to split into two companies, Teck Metals retaining the base metals assets and Elk Valley Resources with the coal assets, but the shareholder vote on that decision was canceled due to the Glencore announcement. Teck recently put out an announcement confirming that they are engaging with multiple parties to pursue the sale of their coal assets. Though no one was named in the release, famed Canadian mining entrepreneur Pierre Lassonde announced in May that he is leading a consortium to bid for the British Columbia coal assets, and Japan’s top steelmaker Nippon Steel is reportedly in talks with Teck as well. Additionally, Glencore has bid an undisclosed amount for the coal assets, which it would merge with its own and spin out to form the largest independent coal company in the world. With the Keevil family controlling Teck opposing the original deal, as well as disapproval of the Canadian government on the sale of its largest mining company, it appears that the Teck-Glencore merger is not going to happen, but the verdict is still out on whether a deal involving the coal assets can be completed.

Battery factory announcements

The past few weeks have seen a slew of new battery investment announcements. Here are the highlights:

A British-led consortium has pledged to invest up to $9B, according to an announcement made by Indonesian Investment Minister Bahlil Lahadalia. The consortium reportedly includes mining giant Glencore, the largest Indonesian nickel producer Aneka Tambang, materials technology company Umicore, and Chinese energy company Envision. The investment is slated to go toward an industrial park in the Bantaeng region on Sulawesi island.

Toyota has upped its planned investment in its North Carolina battery plant by $2.1B to $5.9, as the company aims to start production in 2025 and sell 1.5M EVs per year by 2026. These EVs would be manufactured at its currently under-construction vehicle factory in Kentucky, using the North Carolina batteries.

India’s largest EV manufacturer Tata Group signed an MOU to build a $1.6B battery plant in Gujarat.

GM and South Korean POSCO Group upped investment in their Quebec cathode active materials plant by $1B.

Panasonic announced that they’re developing plans for a third EV battery plant in the United States.

Hyundai and LG Energy Solution are building a $4.3B battery plant in Georgia, close to Hyundai’s EV manufacturing facility. This is a 50-50 joint venture with annual capacity of 30 GWh, enough to power 300,000 EVs. Construction will begin in H2 2023 with production expected to begin in Q4 2025.

Ascend Elements has signed a billion-dollar deal with a yet-to-be-disclosed automaker to produce cathode active materials for use in EV batteries at a plant in Kentucky. The company was founded in 2015 and last year received $480M in grants from the DoE.

That’s all for this week. I’ll be writing on a more consistent cadence going forward, with weekly critical minerals news and a few deep dives in the coming weeks.

Until next time,

Teddy

Well done. Learned a lot about major players in the space. At some point, some general background knowledge, history, cost to develop various types of mines, economics, etc. could be interesting.