The Helium Crisis

Declining production, declining stockpiles, and a major new discovery

We are taking a break from critical minerals this week and focusing on a critical gas: helium.

The United States is short on helium. With rising prices and a depleting reserve, things are not looking great for our supply of this critical gas. But a new discovery in Minnesota may just hold the key to this vast supply challenge.

What is helium used for?

Helium, the second-lightest element, is a gas we hardly interact with but is critical to modern life. With the lowest boiling point of any gas, helium is used to keep objects extremely cool.

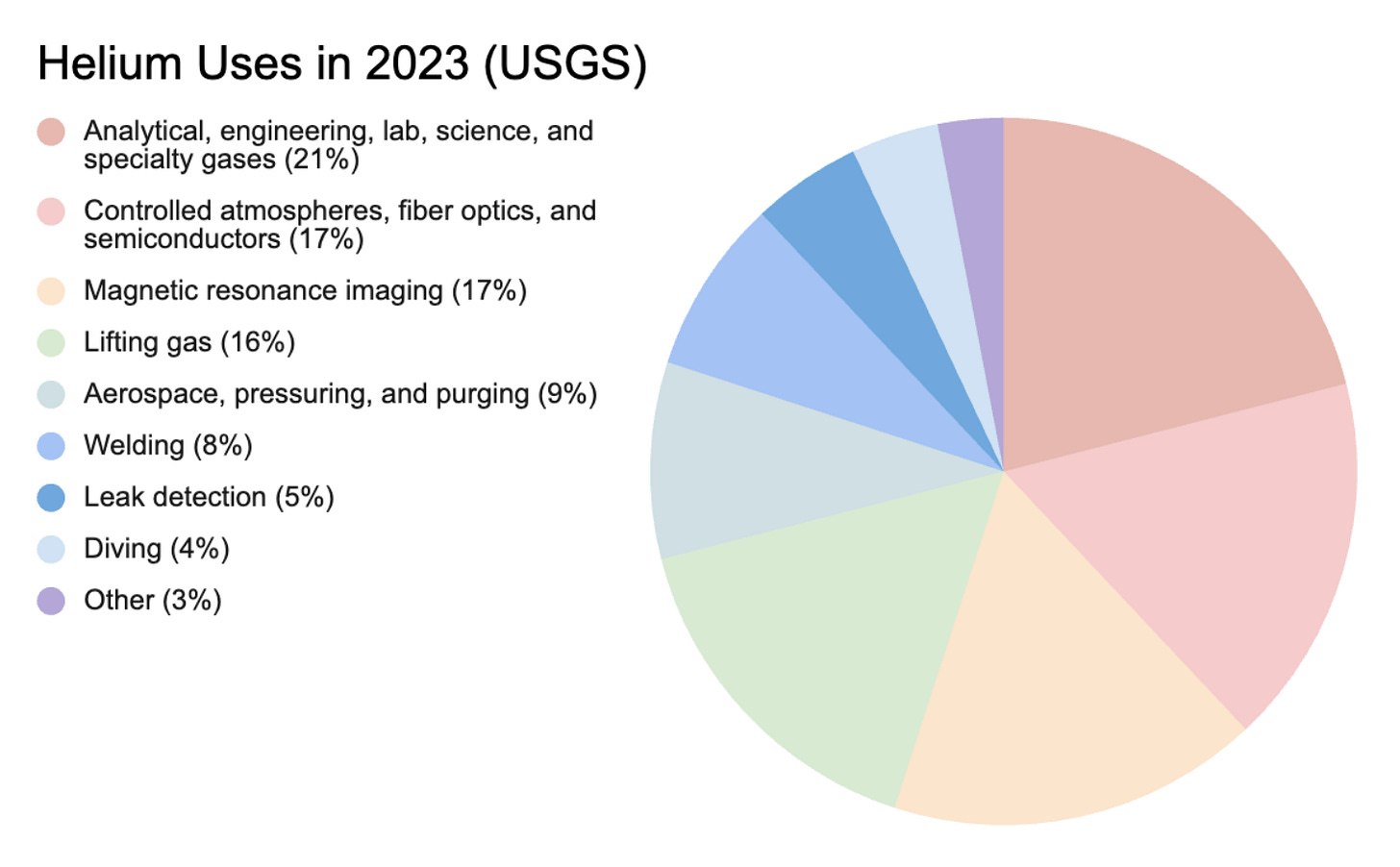

A few of the main uses for helium include:

Cooling superconducting magnets in MRI machines

Cold, inert environment to grow silicon and germanium crystals for semiconductor fabrication

Shielding gas in tungsten arc welding of materials that have high heat conductivity (e.g., aluminum, copper)

Industrial leak detection (helium has a smaller particle size than air, so it leaks quicker)

Airships and weather balloons

Cooling oxidizer/propellant loaded into rockets (the Saturn V used 13M cubic feet of helium per launch)

Helium consumption is expected to grow from 6.1B cubic feet in 2023 ($4.6B) to 8.1B cubic feet ($6.1B) by 2030.

Supply…

Unlike many critical materials, the US produces a significant proportion of helium, with 39.5% of global production (46.5% if you include a drawdown of the National Helium Reserve at Cliffside Field).

The US is even a net exporter of helium, exporting 20M cubic meters more than imported in 2023.

Helium is produced deep underground as a byproduct of the radioactive decay of uranium and thorium. The gas migrates upwards and becomes trapped in formations where the overlying rock is impermeable, often in pockets of natural gas.

The vast majority of helium is produced as a byproduct of natural gas extraction. Though often just 2-3% helium, these natural gas reservoirs are massive. Some fields contain higher percentages of helium (5-10%), but usually with a nitrogen content 10 or more times that of helium and high levels of carbon dioxide. Due to the high nitrogen and CO2 content, these fields usually do not contain an economically extractable portion of methane and are thus drilled exclusively for the helium content. US helium production primarily comes from natural gas fields in Texas, Oklahoma, and Kansas.

Shortage

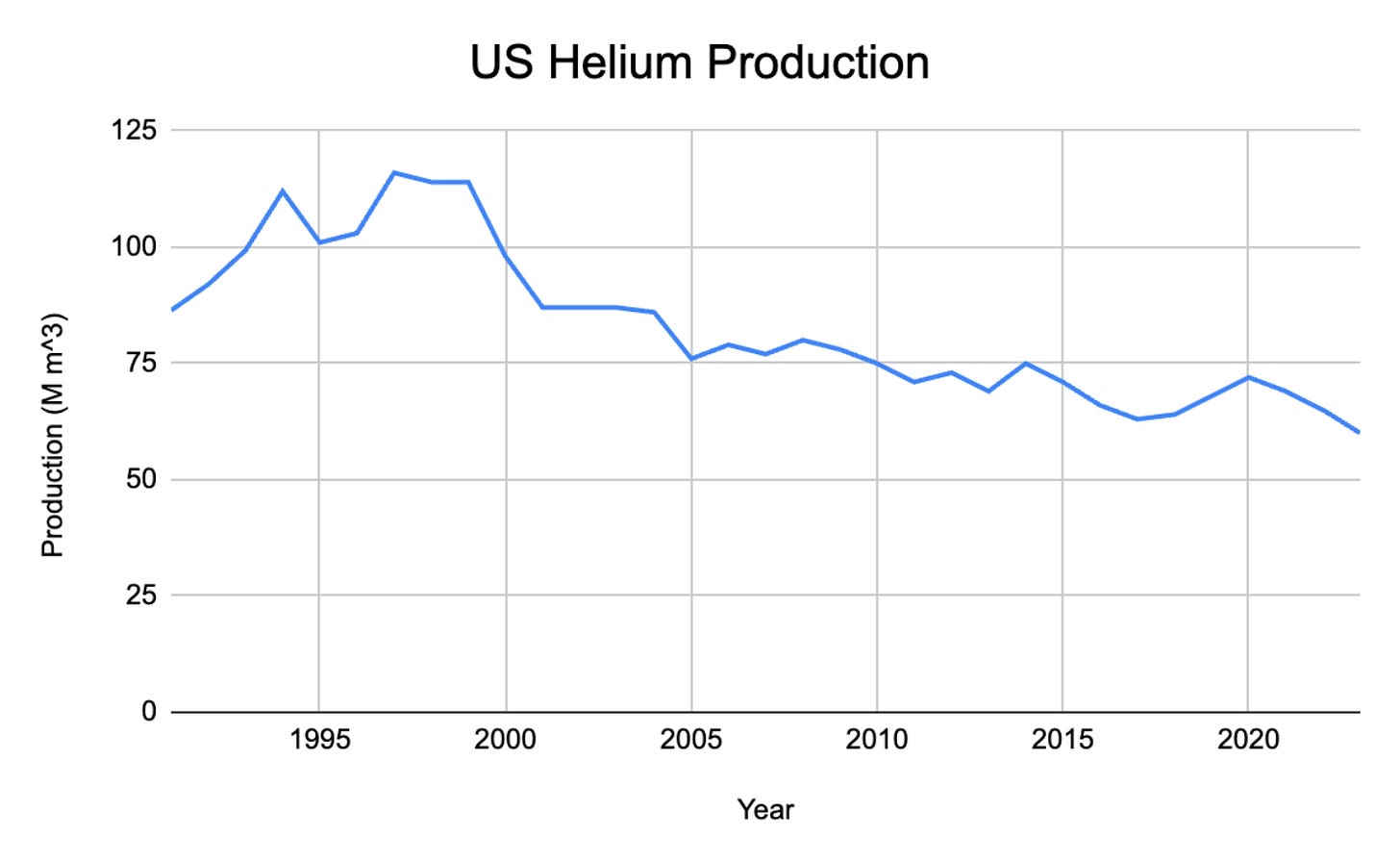

Even though the US produces more than any other nation, we are in the midst of an escalating helium supply crisis. Over the past 25 years, production of helium in the United States has collapsed. In 1999, the US produced 118M cubic meters; in 2023, 59M cubic meters.

Due to this gas’s importance, the National Helium Reserve was established in 1925, but by 1996 was $1.4B in debt. This prompted Congress to pass the Helium Privatization Act of 1996 and begin selling off the reserve by 2005.

For the past 20 years, the helium reserve has been steadily declining. At the same time, government sales flooded the market with cheap helium, resulting in many private companies shutting down operations.

In 2013, the Helium Stewardship Act of 2013 was passed, ordering the remainder to be sold off by 2021, but at a higher price. The final sale of helium from the reserve was completed just last month. German industrial gases company Messer Group bought 425 miles of pipelines in Texas, Kansas, and Oklahoma and over 1 billion cubic feet of helium.

With the strategic reserve depleted, the next few years could see the US flip from a net exporter to an importer for the first time in decades, reliant on nations like Qatar, Algeria, and Russia for this critical resource.

While helium was included in the draft list of critical materials released by the USGS in 2018, it was not included in the 2021 edition. The 2020 Energy Act narrowed the criteria for materials included in the list to focus on quantitative production statistics as the primary means of assessing supply chain risk. Because the US was producing an abundance of helium, it was excluded. However, this does not account for America’s rapidly declining share of global production, with countries like Russia and Qatar rapidly increasing their share. In 2022, Senators John Barrasso and Mike Lee wrote a letter to Secretary of the Interior Deb Haaland, urging her to reject the USGS’s proposed removal of helium (and uranium) from the list, but to no avail.

Inclusion as a critical material would place a renewed emphasis on securing helium supply, potentially reversing asinine maneuvers like selling the national stockpile.

It is now up to exploration companies to find new sources of this strategic gas.

A new discovery

More than a decade ago, a small exploration company called Duluth Metals was exploring for nickel near Duluth, MN. In 2011, in a drill hole looking for nickel, the company hit a pocket of gas at 542 m beneath the surface. Gas flowed with no reduction in pressure for 4 days. After sending a sample to the University of Toronto, results came back revealing the gas contained 10.5% helium.

Years went by, and eventually, the site, now called Topaz, ended up with Pulsar Helium.

To see the extent of the gas discovery, Pulsar Helium used a type of geophysical surveying called Ambient Noise Tomography (ANT). ANT uses passive sensors to detect how the velocity of sound waves changes as they pass through different layers of rock. Gas fields have a lower velocity primarily due to the lower density of gas than surrounding rock and the greater pore space. The cross-section below shows the gas field (green) and discovery hole.

This 950 m depth slice shows the extent of the field in the x and y directions. The velocity anomaly (green) is several miles across, and open to the north and west.

In February, the company drilled an appraisal well 50 feet from the discovery well to confirm the findings. The results came back last week even better than expected. Some parts of the field contained up to 12.4% helium, with the well flowing at 3.7% to 5.1% helium (diluted from air pumped in) for more than 5 hours.

There is much more work to be done determining the full extent of this gas field, but the helium content is some of the highest ever discovered. If the 12% helium found is repeated in other drill holes, and sufficient helium is found along the estimated 610 m vertical thickness, this field could begin producing helium in the next few years.

It could even be the key to an impending helium shortage.

Trying to wrap my head around the National Helium Reaerve’s role-- was it a net positive to have a buyer of last resort and that’s gone, or is it the sell pressure of its liquidation that’s troubled the US industry and put us in danger of being an importer? It’s a loose question so if you see a more interesting question to answer from mine please answer that one instead!

Hi Ted, thanks for the article. Have you got any views on the JSE Listed helium play Renergen please?