Finding the New Oil

The mineral exploration process and the startups bringing it into the 21st century

This essay is in collaboration with George Goodfellow, investor at Construct Capital. Check out his Twitter and Medium.

Critical and lucrative. That’s the best way to describe mining. Core to almost every product we have, whether computer chips, batteries, or screens, minerals are in short supply. By 2035, according to Boston Consulting Group research, lithium supply will be 24% less than demand or 1.1 million metric tons. But to build a mine, you first need to know where the material is located and that’s an expensive process.

It all starts with a “hunch” that there’s resources at a location. For a mining company, this could be from past exploration, the type of rock seen at the surface, or discoveries nearby. Once that hunch has been verified to a minimum level of confidence, it’s time to drill some holes. Drill rigs are large pieces of equipment requiring a skilled crew, generally drilling 1–2 holes per day depending on depth. The holes (150 to 2000 ft deep) produce core samples, a piece of rock a few inches wide, which are sent to labs where assays can be completed. When exploring for Lithium in brine specifically, ponds are dug and the concentration of materials measured in the solution. Either way, waiting for lab results takes time. “Right now, Christmas is not coming fast enough, or at all, for many explorers. Geochemistry labs are seriously backed up and explorers are experiencing delays — like three months instead of six weeks!” [Resource Maven]

In the lab, the rock is crushed at defined intervals and tested for mineral content. With this, a geologist knows what rock exists at what depth and combines this with other data to fill in the gaps between holes. The result, weeks to months later, is a predicted map of where the mineral body expands to.

With these results, a company will raise more capital to do more drilling and get a better sense of their resource. At this stage, the goal is a scoping study, generally a 50–100 page document with a general assessment of technical and economic factors that contribute to the proposed mine’s plan. This takes years of work and is only just the beginning of the paperwork mountain required. The company then moves on to a pre-feasibility study (PFS), which includes a first plan for the mine, infrastructure on site, environmental remediation, metallurgical processes, tailings management, and much more. Taking 5–6 years of work, a PFS is a big deal. And we’re still not ready to extract anything yet! Next is the full Feasibility Study. Even more critical in nature, this is the detail-by-detail plan to build a mine, and getting one out is a pretty sure bet the asset will get developed. Developing the PFS and FS, along with acquiring regulator permits, comes at a cost of $10s of millions (plus a few thousand pages of documentation) and years of time.

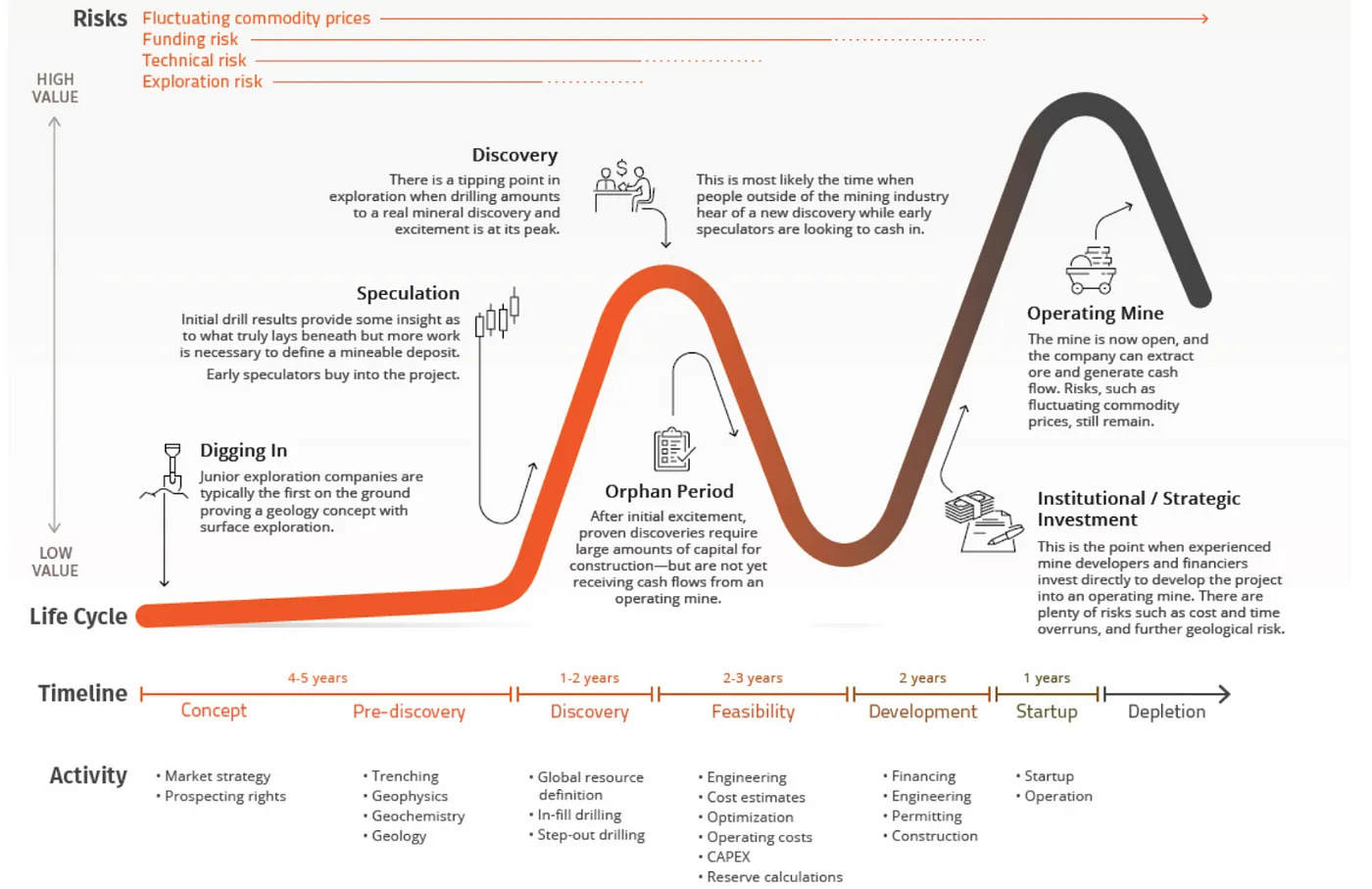

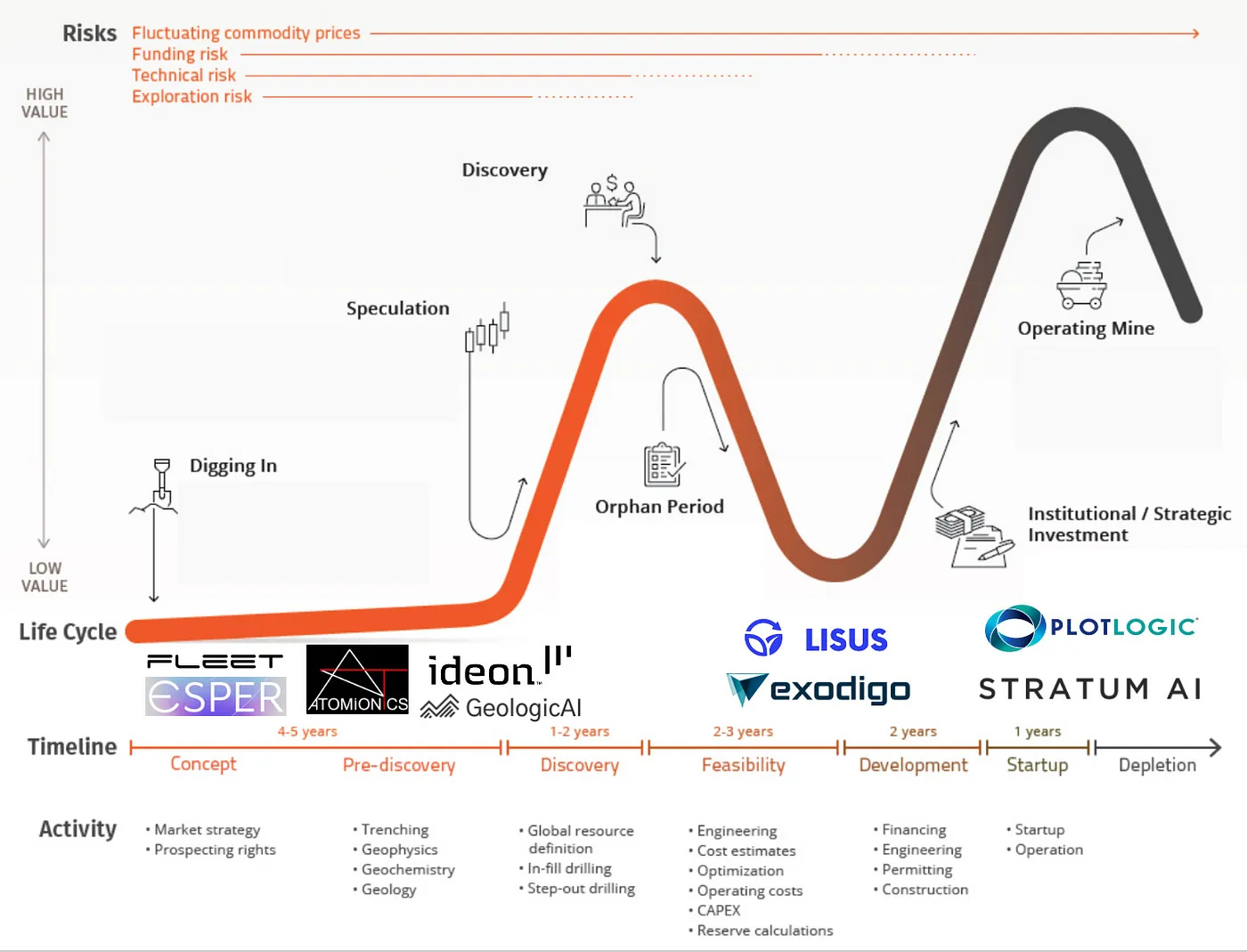

This whole process, even before building the actual mine, is not only expensive and time-intensive but complex with many actors and a changing set of risks at each stage. The process is best illustrated using a Lassonde curve, seen below.

With permits secured, the process of mineral extraction can finally begin…. Kind of. Years of construction begins at a cost of about half a billion dollars to develop the mine of course must come first. Just getting to approval costs tens to hundreds of millions. Getting to extraction puts you half a billion in the negative. Funding comes in large part through equity raises similar to a startup! Debt equity in the project itself is often used, as well as offtake agreements, where a customer pays to secure a supply (offtake) of the resource being developed. For the industry with half a billion dollars of capex before an ounce of product, a few goals are therefore obvious:

Reduce the cost of finding the minerals, both in terms of time and money

Ensure the predicted volume of extractable mineral is as accurate as possible

Maximize the amount of minerals extracted at a particular point

With the continuing shortage of critical minerals and growing need for chips, batteries, and other technologies, market prices for these resources are rocketing. And where there’s pain and money, there’s always opportunities for innovation. A number of companies with varying points of attack are building solutions for making mineral discovery cheaper, faster, and more accurate. The question is, who wins and what does the technological future of mining look like?

MARKET MAP

Company Breakdown:

Esper Satellites

What do they do? Esper is deploying 18 hyperspectral satellites to offer the most advanced geo-data capture the world-over. The company’s custom satellites are equipped with an array of sensors capable of detecting a wider bandwidth of spectral range with greater resolution. Doing so enables material composition detection beneath the earth’s surface.

Fundraising to date: ~$600K

Fleet Space

What do they do? Fleet Space is deploying an array of low cost nanosatellites for IoT connectivity in remote areas. They combine this with a mesh of edge-processing equipped geophones to detect seismic activity for mining exploration. The geophones, small devices placed in the ground, connect to the nanosatellites to effectively reduce the traditional lab time to a few hours.

Fundraising to date: $37.4M

Plotlogic

What do they do? Plotlogic provides a suite of tools for optimizing mine operations by better understanding material quality in the process using a series of advanced integrated sensors. Ultimately, Plotlogic aims to maximize outcomes and reduce waste from multi-moving assets.

Fundraising to date: $23M

Ideon

What do they do? Uses sensors designed to sense the movement through the earth of a form of subatomic particle emitted during a supernova. Doing so enables them to more accurately build an “x-ray” of the land around a drill hole.

Fundraising to date: $16M

Geologic AI

What do they do? Mobile lab setup for drill sample assays and analysis, designed to significantly reduce costs, both in terms of time and money, for exploration in the field.

Fundraising to date: $3.53M

Atomionics

What do they do? In-situ quantum sensing startup that uses a truck-bed device to assess dynamic gravity measurements at a higher spatial resolution in a shorter period of time.

Fundraising to date: $2.5M

Exodigo

What do they do? Exodigo creates accurate and precise underground maps for design, construction, and subsurface discovery. Using multi-sensor fusion, Exodigo searches every square inch of an area to ensure the construction of a 3D model and run simulations. The use of AI makes this process many multiples faster than geologists can currently manage, even without lab bottlenecks.

Fundraising to Date: $29M

Stratum AI

What do they do? Similar to Exodigo, Stratum AI takes in existing data from a mining site to generate a 3D model of an adjacent area in the site and predict the economic outcomes of mining that area. The critical difference is Stratum AI uses the data from the drill holes, whereas Exodigo uses data from a much wider array of sensors (e.g. drone scans). As such, Stratum AI functions in the geostatistics space and compliments the existing workflows of geologists.

Fundraising to date: $156K

The mining space is so large and complex with such a vast number of different minerals and geographic ecosystems that multiple players can exist at each layer. The question becomes, at each layer (new site / greenfield data sourcing, existing site / brownfield data sourcing, and map creation), which technology comes out on top? Winners in this space will learn to balance a trifecta of factors: cost to deploy, integration with existing workflows, and data value. Applying a ranking to these is challenging, however, cost to deploy is often the lowest due to the sheer magnitude of the financials in this industry

Mining is a historical industry that likes to do things how they’ve always been done. We’ve seen this trend in other industries like construction, where new tech has struggled to break ground even when substantially improving results because it doesn’t integrate with existing workflows. We are likely to see a progressive transition rather than an overnight change, so technologies that are lower cost than existing methods but fit within existing workflows to deliver high value data will win. It’s important to assess these by focus area.

Greenfield Data Sourcing:

When discovering new mining sites, approaches can be bucketed into three cores. Leveraging satellite data; data from low height drones; data from surface sensors.

Fleet Space and Esper Space both intend to launch nanosatellites, which is extremely expensive. With the boom of private space flight and satellite launch costs dropping, launching a custom satellite is increasingly easy, however, we still don’t believe this to be necessary. The proliferation of advanced geological data satellites equipped with a vast array of sensors is increasingly making the necessary data more of a commodity, making the need for a custom and expensive satellite redundant.

The counter argument here is that none of these existing satellites carry the necessary grade of sensor to deliver the correct data to the required accuracy. With the complex nature of the sensor arrays necessary for accurate geological assessments, this is likely. Furthermore, the use of nanosatellites vs. larger versions makes the cost more acceptable. There is still risk, however, that this data becomes less valuable as existing satellite data is combined with other greenfield discovery methods.

The alternative to satellite hyperspectral data collection may be to use drones to survey potential mine sites, providing a lower capex access to similar data. The challenge here is two fold. Firstly, assessing the same scale of land in a reasonable amount of time. And secondly, carrying the same grade of sensors. Drones are only able to carry a fairly minimal payload for a smaller amount of time, limiting larger sensor arrays to larger aircraft and satellites.

Some companies are focusing their efforts on novel, lower cost, surface data analysis techniques. These include Atomonics with their gravity sensing system or Ideon with the in-drill hole sensors. The value of this data is yet to be fully proven, especially for Atonomics. Ideon plays in an interesting position, leveraging existing drilling techniques for a smoother go-to-market but ultimately not improving the speed of discovery or reducing the environmental impacts. That said, with mining an industry committed to its existing methods, we see Ideon carving out a niche by dramatically improving the accuracy of existing drill data.

Brownfield Data Sourcing:

Brownfield Data Sourcing is about maximizing the amount of material extracted. The continued use of traditional methods are prone to lab transportation and capacity issues. The integration of advanced sensors and edge processing (Plotlogic’s approach) as well as the increasingly sophisticated use of 3rd party data for continuous mapping, like LISUS, enables decision making that is not only faster but more granular too. When granular decision making can result in hundreds of millions in value, the cost of installing sensors or paying large sums for new data models is minimal. Furthermore, this makes the pricing power of companies like Plotlogic extremely high.

Map Creation:

Map creation is all about assembling the data sources and extracting the most valuable insights, whether that’s previously untapped resources in an existing mine or minimizing waste. Interestingly, Plotlogic can also play in this space, combining existing data sources with its own data to build better maps and dashboards. Of course, the inverse is also true. Stratum AI and Exodigo could begin to offer on-site sensors like Plotlogic to improve their own data flow. Hardware is hard though and companies like Stratum may think it more strategic to offer API integrations for Plotlogic’s data. On the flip side, modeling skills using solvers are extremely complex mathematical and physical problems that Plotlogic would have to buy in. As such, if vertical integration is the strategy of choice over offering data integration APIs, it will most likely come through M&A within the industry.

Stratum AI’s value is doing advanced Geostatistics, improving the interpolation of drilling cores using AI instead of statistical models. Old school geologists, set in their century old ways, may prefer more data to drive existing methodologies vs. entirely new, AI-driven solutions. Stratum AI therefore must overcome the “new tech” barrier to break in, whereas Plotlogic leverages a tried-and-tested desire of geologists as a sales-based approach.

Conclusion:

We’re on the verge of a complete reinvention of the tech stack that drives mining. Though an age-old industry perceived as resistant to change, the mining hardware landscape has evolved in the industry in recent years — now it is time for new software and sensors to be applied. The high value and huge cost drivers of the industry (remember it takes north of half a billion just to get to extraction!) means there is potential for multiple players at all levels operating in the same mines. Despite this, an increasing amount of market shakeout in the varying technologies is likely. As the industry learns its balance of the three factors (cost to deploy, integration with existing workflows, and value of data) and some data sources become more commoditized, we will see some technologies fall to the wayside.

For greenfield, we foresee the integration of modeling company products leveraging third-party satellite data to drive speed and improve initial discovery outcomes along with more advanced drill hole sensor tech once drilling commences. At the brownfield level, the use of Plotlogic-like products, integrating sensors throughout the operation to maximize outcomes with continuous mapping updates while driving efficiency gains is exciting. All of this data, greenfield and brownfield, will come together into a master model.

The winner of this tech stack, however, will own the mining mapping software, taking in the various data inputs both at the greenfield and brownfield stages and modeling them to maximize extraction volumes. Although this stage is not necessarily more or less technically challenging than sensor development, it enables control of the data flows and the sale price of the model (the tangible, useful output for a mining operations team). This theory becomes stronger when you consider the current arms race for data sources between satellite companies like Fleet and Esper and sensor companies like Ideon. Furthermore, with the proliferation of private satellites, satellite data could become increasingly commoditized. For modeling companies, deploying APIs and acting as the pipework for all this data places their software stack at the center of the ecosystem.

Regardless of traditional ways, the necessity to drive up supply means faster, more accurate, and lower cost exploration combined with the maximization of output is critical. Overall, this will lead to a dominant set of companies deploying a new techstack integrated within existing workflows. The centralized model of mine that takes in all data points to provide the most accurate map of resources to guide decision making is the most high value asset. We therefore expect a race to vertically integrate in this direction with a platform play using data-input APIs.

- Teddy and George